If you’re thinking of buying a house, you may be considering a condo. Condominiums, or “condos,” are a popular choice for many first-time homebuyers, homeowners looking to downsize or relocate to a place like Jacksonville, FL, and those looking to purchase a home in a bigger city like New York City, NY.

If you’re interested in condo life, there are some important considerations you need to make before you buy. In this guide, we’ll walk you through:

- What is a condo? The key differences between condos and other property types

- The costs associated with buying a condo

- How to buy a condo, the buying process, and how it differs from buying a single-family home

- The major pros and cons of buying a condo and owning a condo

- Questions to ask when buying a condo

- How to look for red flags when buying a condo

By the end, you should understand if a condominium is right for you. Let’s get started.

What is a condo?

A condominium is an individual housing unit within a multi-unit housing complex. The housing complex could contain as few as two units or more than a hundred. Each unit is individually owned and the owners are responsible for the maintenance and upkeep of their own unit.

One of the most important aspects of condo ownership is that owners are also typically responsible for paying homeowner’s association (HOA) monthly fees. The HOA facilitates the maintenance and upkeep of common spaces, such as parking lots, landscaping, roofs, and recreational facilities (pool, gym, etc.). They decide when to take on large improvement projects and can require assessment fees to cover these projects. HOAs are also responsible for establishing rules and regulations for community members of the condominium complex.

To be a member of the HOA, a person must be a current resident in the complex. In most cases, annual elections are held and condo owners vote for the residents they want to manage the HOA. So if you desire more involvement in the operation of your condominium complex, you can get involved with your HOA.

What is the difference between a condo and an apartment?

Condos and apartments can look very similar. Both typically are single units within a large residential complex, but the major difference between a condo and an apartment is that an apartment is a rented or leased space while a condo is owned.

Apartment complexes are rental communities where a renter occupies each unit. Renters sign leases that lock them into the unit for a certain amount of time. Although apartment complexes don’t have HOAs or HOA fees, most complexes still have rules and regulations about what renters can and can’t do, like how many consecutive nights a guest can stay over, pet limitations, subletting restrictions, and more.

Condo owners typically occupy their condo, but some owners choose to rent out their unit depending on the association bylaws. So it’s possible for people to rent a condo, but even when that happens, the majority of a condo complex will be occupied by owners.

What is the difference between a condo and a house?

The major difference between a condo and a house is that a house is a stand-alone unit. When you buy a house, you buy the structure plus the land it sits on and any other auxiliary buildings. And, unless the home is part of a master-planned community, houses don’t have a homeowner’s association.

Houses come in many shapes and sizes, from small, single-story buildings to large multi-level buildings and their lot sizes can vary depending on where you’re looking to buy. Houses may also have additional features like a garage, driveway, or porch. Usually, the decision to buy a condo versus a house is based on your desire to live closer to the city center or have more space.

Another big difference between owning a house vs. owning a condominium is the maintenance requirements. With a condo, the HOA takes care of most of the maintenance; you just pay the fees and everything else is taken care of. But with a house, you must manage and pay for all the house maintenance on your own.

The last major difference is the return on investment. A house typically increases in value more than a condo will, and houses tend to sell more quickly than condo units. However, the maintenance costs of a house can impact the return on investment greatly. Often, the maintenance costs for a condo are much less than those for a typical house.

What is the difference between a condo and a townhouse?

Like condos, townhouse units typically have shared common areas like roofs and parking lots. Thus, townhouse complexes almost always have HOAs, but townhouse owners typically pay smaller fees. HOAs play less of an important role in townhouse complexes, and they also tend to place fewer restrictions on townhouse owners.

Most townhouses are multi-level homes arranged side-by-side. They tend to offer more square footage than a condo and larger private outdoor spaces. Where a condo occasionally comes with a balcony or patio, most townhomes have at least a small garden space.

However, townhouse complexes tend to have fewer amenities compared to a condominium. While this isn’t always the case, it’s often harder to find resort-style amenities when shopping for a townhouse.

Typical condo association fees

The average range for monthly HOA fees is between $200 and $400. However, some HOA fees can be much higher or lower depending on where you live, the age of your building, and the amenities offered.

Condo developments in large metro areas and older condo buildings tend to have higher monthly fees. If you’re looking to buy a condo in a high-rise complex with ocean views, expect to pay much higher HOA fees, sometimes more than $1,000 a month.

You may think that the lower the HOA fee, the better, but that’s not always the case. Be wary of complexes with HOA fees lower than $200 a month because it can indicate an under-managed HOA or an HOA with little cash reserves. When an HOA has small cash reserves. it will have to charge assessments for the entirety of project costs. For example, when it comes time to replace a roof, you’ll find yourself paying a hefty assessment fee.

Always be sure to get all pertinent information about your potential condo’s HOA before you buy.

Pros and cons of buying a condo

There are many advantages and drawbacks to condo ownership, so it’s important to consider how each would affect your lifestyle and financial stability before deciding if condo living is right for you. Check out the following pros and cons of buying a condo:

| Pros | Cons |

| Regular exterior maintenance is taken care of by the HOA and there is no yard upkeep required. | HOA may mismanage common area upkeep and maintenance, plus interior home maintenance can still be very expensive. |

| Condos are typically less expensive than buying a house and require a lower down payment. | Condo fees add to your monthly payment, which can make them more expensive than other options. |

| Condos are often in desirable locations, offering city amenities and for a much lower price than single-family homes in the same area. | Condos tend to appreciate at a slower rate than a single-family home. |

| HOA dues are often less expensive and easier to manage than paying for maintenance and improvements on your own. | You don’t get to decide what maintenance projects to take care of and when to pay for upgrades. |

| Your condo comes with a built-in community. | Condos often take longer to sell. |

| Smaller square footage means less time cleaning and lower costs for interior updates (flooring, paint, etc.). | The average condo is smaller than the average single-family home. |

| HOA rules and regulations reduce the chances of bothersome neighbor-habits, such as loud music. | You may find that HOA rules and regulations are too restrictive. |

| Condos often offer added security with locked entries, security guards, and nearby neighbors. | Mortgage rates for a condo tend to be higher than rates for a single-family home. |

| Condos often come with fitness centers, pools, clubhouses, and other amenities. | Because condos are shared communities, you will have less privacy than you would if you owned a single-family home. |

| If you’re looking for a home in a densely populated area, there are often more condo options than house options. | You don’t own the land the condo is on. |

Another point to consider about the pros and cons of buying a condo is that many of the drawbacks of condo ownership can be mitigated or avoided by performing due diligence before buying. Your due diligence should include the following:

- Review HOA documents and your financial strength.

- Choose a condo in a desirable location, ideally one with amenities and low property taxes.

- Talk to your potential neighbors to see if they are a good community fit and to hear what they have to say about the HOA.

How to buy a condo

Your first step to buying a condominium is to decide if a condo is the right fit for your lifestyle. Determine that the advantages of condo ownership outweigh the disadvantages. And be sure that a condo can fit your lifestyle in the near future— it’s usually best to hold a property for five to seven years before reselling.

After deciding that a condo is the right fit, you should hire a real estate agent who has significant experience with how to buy a condo and condo sales in your desired location. Be sure to prioritize your housing needs and wants and share this with your agent. You also want to be preapproved for your mortgage, so you know your price range.

When you find a property you want to buy, follow these important steps:

- Understand the monthly association fees and what they cover.

- Review the HOA documents and assess for financial stability.

- Decide if the HOA rules and regulations fit your needs.

- Review the history of special assessments and HOA fee increases.

- Read reviews of the management company or whoever is managing the maintenance of communal areas.

- Speak to neighbors about the HOA and community life at the condo.

Questions to ask when buying a condo

Before purchasing your condo, you need to review the HOA documents, often called the HOA binder. The binder has all the rules, bylaws, and financial information you’ll need to determine if it’s a good fit for you. The binder should contain a lot of documentation, so it’s important to review it with a knowledgeable person— another reason why choosing a realtor with significant condo-buying experience is so important.

As you review the binder, these are the questions you should ask yourself or your realtor:

- Do the rules, covenants, conditions, and restrictions (CC&Rs) fit your lifestyle?

- Are there limits on HOA dues increases? How often have dues gone up in the past, and by how much?

- How large is the reserve fund, and does it provide enough cushion for repairing or replacing communal property?

- What do you as a resident have the right to vote for or against? For example, special assessment projects.

- Do the HOA meeting minutes show a well-functioning organization or one with a lot of in-fighting?

One of the red flags when buying a condo you should take note of is if the HOA doesn’t have a binder or other documentation to share with you. While there are some situations where little documentation is normal, that’s not the case for most condominiums.

Buying a condominium vs. house: What’s the difference?

Buying a condo is quite similar to buying a home, as you’ll work with a realtor and loan officer to purchase your home. However, you’ll need to do an advanced investigation into the HOA, which you likely wouldn’t need to do if you were buying a home.

Condos offer great advantages as an investment; however, they often appreciate at lower rates than single-family homes. This is of course dependent on the specific location and housing market.

To ensure you get the most out of your investment, you need to dig deep before you buy. With any home buying process, you should be doing a lot of research and be aware of any red flags when buying a condo. Since it’s difficult to do this research alone, this is another reason why working with a condo specialist is always a good idea.

Types of condos

When you buy a condo, you buy what’s known as a “freehold condo,” where the unit is owned by the tenant. This is in contrast to a leasehold condo, where the tenant has a lease contract with a landlord.

There are several types of freehold condos:

- Condo home: this is what you think of when you think of a traditional condo. The owner owns the interior of the unit, while the exterior is owned and maintained by the association.

- Timeshare condo: this is used as a vacation home or second home and is owned by several people who purchase a “share” of the house. Shareholders are given specific dates and the number of days of occupancy. They pay maintenance fees and taxes.

- Detached condo: these condos don’t have shared walls and are typically called “planned communities.” Detached condos are popular in retirement communities.

Condos come in many different forms, some of which may be more appealing than others. In your market, you may find:

- High-rise buildings, often offering city or other views.

- Mid-rise buildings with elevators for ease of access.

- Low-rise buildings, offering more visibility of the sky and better natural light.

- Small, medium, or large residential units, depending on the building.

How to find condominiums for sale on Redfin

Finding a condo on Redfin is easy. To get the most out of your search, use these filters to narrow your search to only the property types that fit your needs:

1) Go to Redfin.com and type into the Search Bar either the city’s name or the zip code, for example, Miami, FL, where you’d like to begin looking for a condo. Press enter.

2) Near the top of the next page, on the right side, you will see “Home type”. Click on that and select “Condo” from the drop-down list.

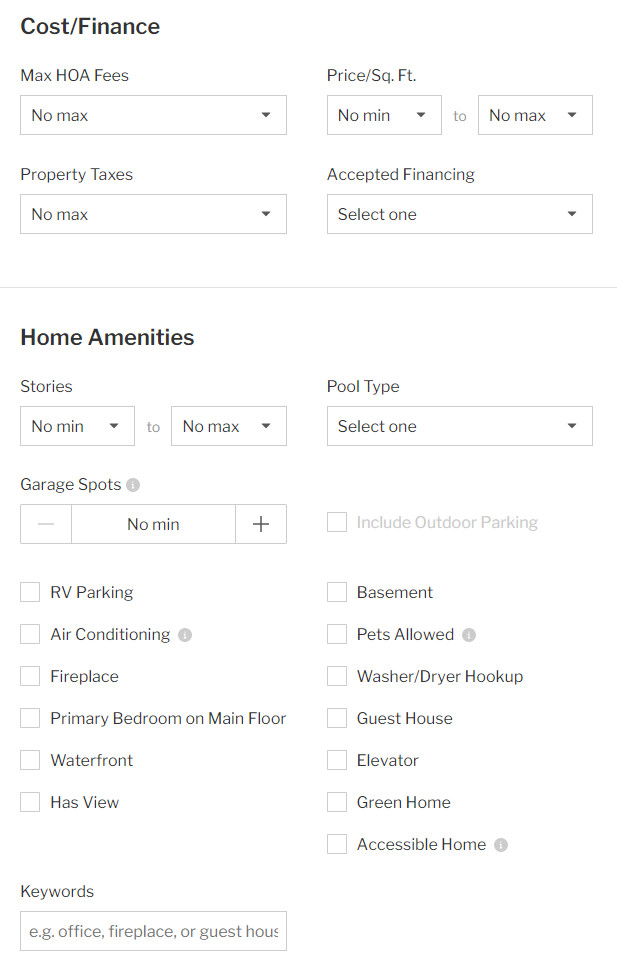

3) Click on the “All filters” button and personalize your search by selecting your desired number of bedrooms and bathrooms, max HOA fees, price range, added features, and more. Press, “See X homes” and it’s that simple! All condos within the city name or zip code you entered along with any other filters will populate the page, and you’ll be able to begin your search.

The post What is a Condo? What You Need to Know Before Buying One appeared first on Redfin | Real Estate Tips for Home Buying, Selling & More.