Are you dreaming of owning a piece of the American Southwest? Arizona, with its vibrant desert landscapes, sunny weather, and diverse cultural attractions, offers an irresistible allure for those seeking a new place to call home. However, before embarking on this exciting journey, it’s essential to understand the homebuying process specific to the Grand Canyon State. From navigating local regulations and financial considerations to finding your perfect abode in a downtown Phoenix condo or a serene house in Gilbert, this Redfin article will serve as your comprehensive guide to buying a house in Arizona.

So, fasten your seatbelts as we explore the steps, intricacies, and tips to make your Arizona homebuying experience smooth and successful.

What’s it like to live in Arizona?

With its year-round sunshine and warm climate, Arizonans enjoy an outdoor-centric lifestyle by hiking, golfing, and exploring the vast desert landscapes. The state is also home to several renowned national parks and monuments, including the breathtaking Grand Canyon and the stunning red rocks of Sedona, providing endless opportunities for adventure and exploration. Arizona is also known for its intense summer heat, and protecting yourself and your property when living there is essential. Check out this article to learn more about the pros and cons of living in Arizona.

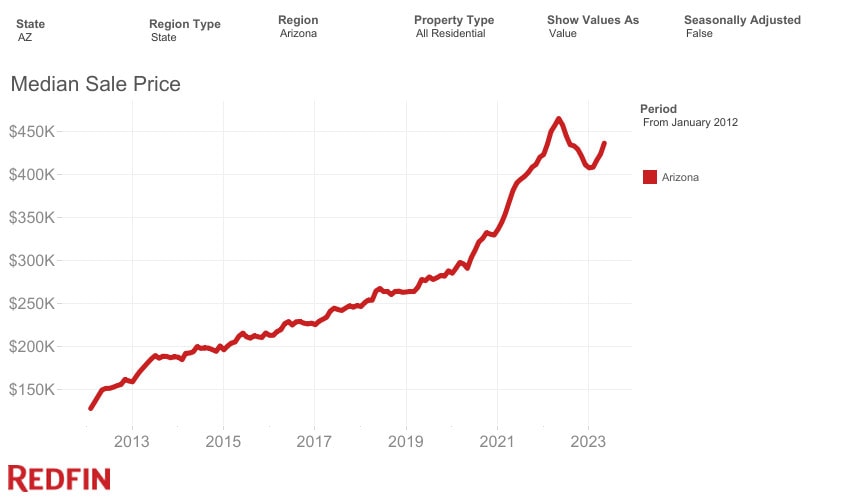

Arizona housing market insights

The Arizona housing market is experiencing some notable trends and shifts. The median sale price currently stands at $436,100, showing a 6.2% decrease compared to the previous year. Several cities in Arizona have emerged as competitive real estate markets, including Pinetop, Flagstaff, and Cottonwood. Popular cities in the Phoenix area, such as Scottsdale, Chandler, and Gilbert, are also witnessing significant growth and attracting prospective homebuyers. However, the housing supply in Arizona has decreased by 4.7% year-over-year, indicating a tightening market. These data points suggest a dynamic and evolving housing market in Arizona, with fluctuating prices, competitive cities, and limited supply, all of which have implications for buyers.

Finding your perfect location in Arizona

For several reasons, selecting the perfect location for buying a house in Arizona is vital. First and foremost, Arizona offers diverse landscapes and communities, each with its unique charm and amenities. By carefully considering your desired location, you can align your lifestyle preferences with the area’s offerings. Additionally, the location of your home greatly impacts factors such as commuting time, access to essential services, quality of schools, proximity to recreational opportunities, and potential appreciation of property value over time.

If you’re unsure where to start, using tools like a cost of living calculator can help you determine what cities are within your budget. We’ve put together a glimpse of the five popular cities, so you can get an idea.

#1: Tucson, AZ

Median home price: $330,000

Tucson, AZ homes for sale

Moving to Tucson offers a unique and vibrant experience that blends desert beauty, cultural richness, and a relaxed atmosphere. Outdoor enthusiasts can delve into the picturesque trails of Saguaro National Park, embark on invigorating hikes or bike rides in the nearby Catalina Mountains, or indulge in a round of golf on world-class courses. Embracing its rich cultural heritage, Tucson boasts a thriving arts scene featuring captivating museums, art galleries, and the renowned Tucson Gem and Mineral Show. While the cost of living in Tucson exceeds the national average by 4%, there are affordable Tucson suburbs, ensuring a balance between cost-effectiveness and access to the city’s attractions.

#2: Mesa, AZ

Median home price: $440,000

Mesa, AZ homes for sale

As the third-largest city in Arizona, Mesa is known for its suburban neighborhoods, well-maintained parks, and outdoor activities. Moving to Mesa, you’ll enjoy over 300 days of sunshine each year, making it ideal for outdoor enthusiasts. Explore the nearby Superstition Mountains, go hiking or biking in Usery Mountain Regional Park, or enjoy water sports at the nearby Saguaro Lake. Mesa also offers a rich cultural scene, with attractions such as the Mesa Arts Center, which hosts a variety of performances, exhibits, and festivals throughout the year.

#3: Phoenix, AZ

Median home price: $439,950

Phoenix, AZ homes for sale

Known as the Valley of the Sun, Phoenix is a bustling metropolis with a thriving economy, vibrant culture, and many amenities. With a move to Phoenix, residents can enjoy an abundance of sunshine throughout the year, allowing for a wide range of outdoor activities such as hiking, golfing, and exploring the scenic desert landscapes. Phoenix is home to major sports teams, including the Phoenix Suns and the Arizona Diamondbacks, offering exciting opportunities for sports enthusiasts. Additionally, if you’re looking for affordable Phoenix suburbs, several options provide a more budget-friendly housing market while offering access to the city’s amenities.

#4: Flagstaff, AZ

Median home price: $645,000

Flagstaff, AZ homes for sale

Flagstaff enjoys all four seasons, attracting residents who revel in the mesmerizing hues of autumn, the snowy winters that offer thrilling skiing and snowboarding opportunities at Arizona Snowbowl, and the mild summers perfect for hiking and camping. If you’re a lover of stars, moving to Flagstaff will grant you the chance to experience the Lowell Observatory, where residents can delve into the wonders of the night sky. It’s worth noting that the cost of living in Flagstaff is 14% higher than the National Average. Still, the city’s unique offerings and natural beauty make it a worthwhile investment for those seeking an exceptional living experience.

#5: Scottsdale, AZ

Median home price: $830,000

Scottsdale, AZ homes for sale

Scottsdale is renowned for its world-class resorts, spas, and golf courses, attracting visitors and residents seeking relaxation and indulgence. Scottsdale’s Old Town showcases a charming blend of historic charm and modern sophistication with its trendy boutiques, art galleries, and renowned dining establishments. Moving to Scottsdale can be expensive, with the cost of living exceeding the national average by 13%. If you want to stay on a budget, there are affordable suburbs outside downtown.

The homebuying process in Arizona

If the allure of Arizona has swept you away, and you have your heart set on a specific city or neighborhood, it’s time to dive into the homebuying process.

1. Prioritize your finances

Getting your finances in order is crucial when buying a house in Arizona. You can position yourself for a smooth and successful homebuying journey with careful financial planning and preparation. Start by assessing your credit score and addressing any issues to ensure you qualify for favorable loan terms. Next, determine your budget and calculate how much you can comfortably afford, considering factors like down payment, closing costs, and monthly mortgage payments. Using tools like an affordability calculator can help you determine your budget.

Various programs are available for first-time homebuyers in Arizona, including the Pathway to Purchase, which can assist with up to $20,000 in down payment and closing cost assistance.

2. Get pre-approved from a lender

Securing a pre-approval when buying a home in Arizona can provide numerous advantages. By obtaining pre-approval from a reputable lender, you clearly understand your financial standing and borrowing capacity. This knowledge empowers you to set a realistic budget, ensuring you focus on homes within your price range. Pre-approval also enhances your credibility as a buyer, demonstrating to sellers that you are serious and financially qualified.

3. Connect with a local agent in Arizona

Working with a local agent during the homebuying process in Arizona is of utmost importance. Local agents possess invaluable knowledge and expertise specific to the Arizona real estate market, which can significantly benefit buyers. They are well-versed in the intricacies of different neighborhoods, market trends, and pricing dynamics across the state. So whether you need a real estate agent in Tucson or an agent in Phoenix, they’re here to help.

4. Start touring homes

When touring homes in Arizona, keep a discerning eye and consider key factors that can influence your decision. First, pay attention to the home’s location and neighborhood. Consider proximity to schools, amenities, and commute times to ensure it aligns with your lifestyle. Assess the property’s condition, checking for any signs of wear, structural issues, or potential maintenance needs. Look for natural lighting, functional layouts, and ample storage space that meet your requirements.

5. Make the offer

The offer is a critical aspect of the homebuying process in Arizona, carrying significant weight in determining whether your dream home becomes a reality. Crafting a strong offer is essential to stand out in a competitive market. Consider the listing price, property condition, and local market trends to determine a fair and competitive offer. Your offer should include the purchase price, contingencies, and desired timelines for inspections, financing, and closing.

6. Close on the house

The closing process is a pivotal moment in the homebuying process in Arizona, where all the necessary paperwork is finalized, and ownership of the property is transferred. It’s a critical step that requires careful attention to detail and a thorough review of the closing documents. During the closing, you will sign various legal documents, including the mortgage, deed, and other necessary paperwork. It’s essential to carefully review and understand these documents before signing to ensure you know the terms and obligations.

If you’re new to the process and still have questions, Redfin is here to help. The First-Time Homebuyer Guide goes into more detail about each step in the homebuying process.

Factors to consider when buying a house in Arizona

Due to Arizona’s geographical location, there are distinct factors to consider when buying a home.

Climate and weather

When buying a house in Arizona, it is crucial to consider the climate and weather, as well as the impact climate change is having in the state. Arizona offers a diverse range of climates, with hot summers exceeding 100 degrees Fahrenheit (38 degrees Celsius) in desert areas like Phoenix and Tucson. These cities are also known for their mild and pleasant winters, attracting snowbirds and retired individuals seeking warmer temperatures. On the other hand, the northern parts of the state, including Flagstaff and Sedona, provide a cooler and more moderate climate, with snowy winters and comfortable summers. Homebuyers must take into account their preferences and tolerance for extreme heat or cold when selecting a location within Arizona.

Additionally, the state’s unique desert climate presents both advantages and challenges. Efficient cooling systems and proper insulation are necessary to combat the intense summer heat, while the dry weather increases the risk of drought and wildfires, prompting homeowners to consider shade availability, outdoor living spaces, and landscaping options to mitigate the sun’s impact.

Dual agency

Arizona allows for dual agency in real estate transactions, which refers to a real estate agent representing both the buyer and the seller in the same transaction. In dual agency, the agent acts as a neutral intermediary, facilitating the transaction and ensuring a fair process for both parties. However, it’s important to note that dual agency requires all parties’ informed consent.

Buying a house in Arizona: Bottom line

Navigating the homebuying process in Arizona requires careful consideration and strategic decision-making. From understanding the importance of location to getting finances in order, securing pre-approval, and working with local agents, each step plays a vital role in achieving a successful and satisfying home purchase. By being well-informed, proactive, and adaptable, homebuyers can confidently navigate the Arizona real estate landscape and find their perfect place to call home in this beautiful southwestern state.

Buying a house in Arizona FAQ

What are the requirements for buying a home in Arizona?

To start it off, a down payment is necessary, although the specific amount can vary depending on factors such as the loan type and lender requirements. A good credit score is also crucial, with a minimum score of around 620 often preferred for conventional loans. Income and employment verification is required to demonstrate the ability to repay the mortgage. Lenders assess the debt-to-income ratio to ensure borrowers can manage their monthly payments. It is advisable to conduct a property appraisal and home inspection to determine the value and condition of the property.

What is a typical down payment on a house in Arizona?

A typical down payment on a house in Arizona can vary depending on various factors. Generally, it ranges from 3% to 20% of the purchase price. The percentage often depends on the loan type, lender requirements, and the borrower’s financial situation. For conventional loans, a down payment of around 20% is ideal for avoiding private mortgage insurance (PMI). However, options are available for lower down payment percentages, such as 3% or 5%, particularly for first-time homebuyers or through government-backed loan programs like FHA loans.

What credit score do I need to buy a house in Arizona?

When buying a house in Arizona, the credit score requirement can vary depending on the type of loan and the lender’s criteria. Generally, a good credit score is preferred to qualify for favorable mortgage terms. A minimum credit score of around 620 or higher is typically required for conventional loans. However, loan programs, such as FHA loans, offer more flexibility and can accommodate borrowers with lower credit scores, sometimes as low as 580. It’s important to note that a higher credit score generally improves your chances of securing a mortgage with competitive interest rates and favorable terms.

The post The Ultimate Guide to Buying a House in Arizona appeared first on Redfin | Real Estate Tips for Home Buying, Selling & More.