Demand for housing was strong in early 2020, before the COVID-19 crisis hit. Mandated shut-down measures and the fear of what COVID would do to our economy temporarily immobilized the housing market, evinced by nine weeks of declines in the weekly purchase applications data on a year-over-year basis. Then it was as if the Housing Demographic God exerted her chronokinetic powers to snap demand back to pre-COVID levels of growth. The frozen market thawed and resumed its steady pace of growth, even making up for lost time.

Instead of a housing crash, as many others predicted would be the lasting consequence of shut-down policies and massive job losses across the nation, the opposite happened as the 2020 U.S. housing market has been the most out-performing economic sector in the world.

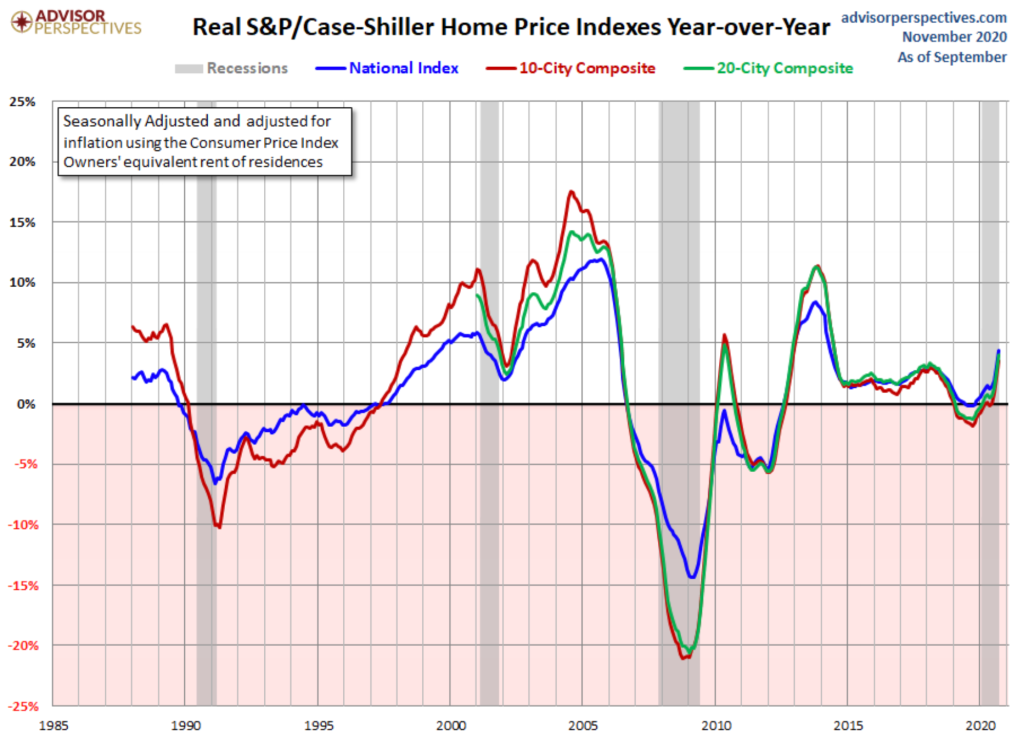

However, we now have another issue to worry about — that home prices will accelerate too quickly, unrestrained by an increase in mortgage rates. As you can see below, we have deviated from the normal price growth that had been the trend in recent years.

My biggest fear for the housing market in years 2020-2024 was never a lack of demand, as the housing bubble boys have been trolling about the last eight years — it was an unhealthy rate of price growth due to demographics and low mortgage rates.

When demographics are good for housing, meaning we have a large number of our populace at home-buying age, demand — and thus home prices — can be moderated by higher interest rates. We were witness to this in 2018 when mortgage rates increased to 4.75%-5%, demand fell and the rate of growth of real home prices went negative, year over year.

That was then and we can clearly see this isn’t the case anymore.

The post The downside of the hot 2020 housing market: rapid home-price growth appeared first on HousingWire.