Let me be contrarian: Get ready, because mortgage rates are going to rise in 2021. Now before you respond, just read the rest as to why.

The Mortgage Bankers Association in its most recent forecast sees two things that stand out. First, 2020 will prove itself to be the second biggest mortgage year in history. Topping $3 trillion will put it only behind 2003 in single family mortgage production history.

Second, the MBA joined the GSEs and other economists who forecast a significant drop in mortgage production in 2021, with most estimating declines in the range of $700 – $800 billion year over year.

Some will try to argue, “but wait, Powell said the Federal Reserve would keep rates low for the foreseeable future! You must be wrong.” There is a difference here. Yes, the Fed will likely keep short rates low, but mortgage rates and some longer-term Treasuries likely won’t enjoy the same ride.

Here are the reasons why upward pressure on mortgage rates could stall the refinance wave and cut overall national originations volume in 2021:

1. The Fed: The Federal reserve is the single biggest buyer of agency mortgage backed securities (MBS) in the world. According to the Urban Institute, “In March the Fed bought $292.2 billion in agency MBS, and April clocked in at $295.1 billion, the largest two months of mortgage purchases ever; and well over 100 percent of gross issuance for each of those two months. After the market stabilized, the Fed slowed its purchases to around $100 billion per month in May, June and July. Fed purchases in July were $104.6 billion, 35 percent of monthly issuance, still sizable from a historical perspective.”

The question is what happens after a covid vaccine and a normalization of economic activity which is expected next year. The Fed is already being very careful not to commit to MBS purchases after the end of this year, a lack of commitment very different to their clear stance on fed funds. If the fed continues to slow or stop, something which is inevitable, the supply imbalance will force rates higher as MBS prices drop in search buyers to take up the excess.

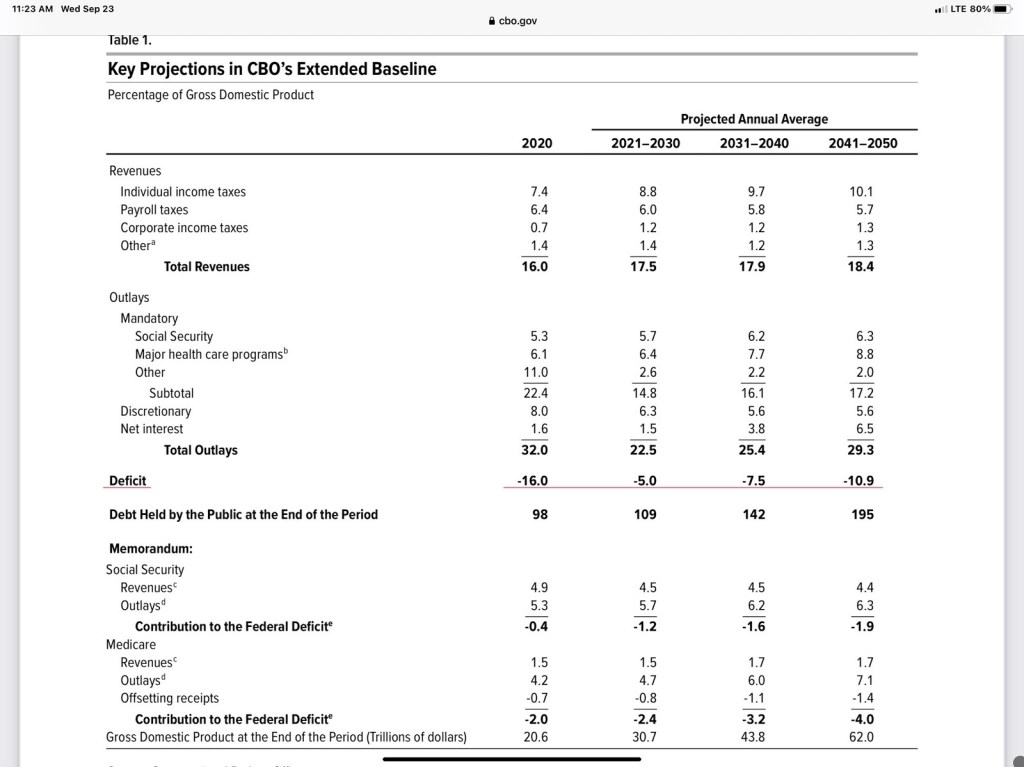

2. The Debt: The national debt is now at 100% of GDP, the highest level since WWII. Per CBO’s September paper, “By the end of 2020, federal debt held by the public is projected to equal 98% of GDP. The projected budget deficits would boost federal debt to 104% of GDP in 2021, to 107% of GDP (the highest amount in the nation’s history) in 2023, and to 195% of GDP by 2050.”

The CBO’s projections for the U.S. deficits looking forward and the mounting debt load threaten the nation’s ability to do many things, as the majority of spending will be to mandatory expenditures that include interest on the growing debt load. Inflationary pressure will result from the need to finance these deficits through new issuance of treasuries, thus putting upward pressure across the stack of interest rates, a far different outcome than what the Fed may do to keep short rates low.

3. The GSE Capital Rule: The FHFA just closed off the comment window on the proposed capital rule for Fannie and Freddie. This rule is a critical component to FHFA’s plan to release the GSEs from conservatorship. The proposed rule is considered onerous by many with the consensus view stating in comment letters that rates would rise between 20-30 bps. Former Freddie Mac CEO Don Layton, former Arch MI CEO Andrew Reppert, and Fannie Mae each stated the same in their comment letters.

4. The Adverse Market Fee: This arbitrary add-on for most refinance mortgages from the GSEs of 50 bps equates to roughly an increase in rate of .125. This goes into effect on Dec. 1 of this year.

5. Release from Conservatorship: FHFA Director Calabria is working feverishly to release Fannie and Freddie from conservatorship and moving at a pace to lock in as much of this as possible quickly given the risk of an administration change. There have been outcries from MBS investors, including some of the largest buyers.

As reported, in a letter to Mark Calabria, director of the Federal Housing Finance Agency, PIMCO said freeing the companies by executive fiat would be interpreted by investors as an end to the government’s guarantee of the MBS. “That would boost mortgage rates and force some investors to sell the bonds,” the PIMCO executives said. Investors would demand a higher return for the increased risk. “Mortgage rates will increase, homeownership will likely suffer and the national mortgage rate will no longer exist,” the executives wrote.

For those in the mortgage industry, it doesn’t take all of these things to result in the forecasted 700-800 billion drop next year. Frankly just the slowing of MBS purchases and the implementation of the capital rule alone would do it. In fact, MBA’s forecast of the volume decline assumes only the slightest increase in mortgage rates, remaining in the low 3% range next year. In my conversations with economists, the view is that we will end the year with a good first quarter in 2021 simply based on year end overflow.

The second quarter may start off well, but the general sense is that by the third and fourth quarters the market will reflect the impact of coupon burn out and any of these events above beginning to take shape. One thing for certain is that the Fed does not like being in this deep, we saw that following QE activities during the Great Recession.

As MBA’s Fratantoni states in his recent Housing Wire article, “2020 has been a banner year for mortgage originators and the millions of households who have benefitted from record-low rates through refinancing. The industry will enjoy this boom for a while longer, but our expectation is that the refi wave is cresting.”

“Make hay while the sun shines” is an old expression. The sun is clearly shining on our industry this year. But it’s important for mortgage banking executives to not misread the statements of Chairman Powell as a commitment to anything more than short rates. The rally you are experiencing this year is due to interventions in the market due to a pandemic recession. Normalization will take out buyers, eliminate the supply “short,” and inflation will ultimately do its thing on rates just enough to cut the market by 25%-30% in 2021 and a bit more in 2022.

Planning ahead for that environment is critically important as market contractions will reduce spreads as well as volume. Thinking about the appropriate right sizing and forward-looking market strategies now will separate the winners from the rest.

The post [PULSE] 5 reasons mortgage rates will fall in 2021, according to Dave Stevens appeared first on HousingWire.