This week, the Community Home Lenders Association (CHLA) repeated their call for FHA to lower premiums and to eliminate the life of loan premium on FHA loans. While I might have a different view on the life of loan premium, I applaud their call and cannot understand why HUD has not yet lowered FHA premiums. It’s dumbfounding.

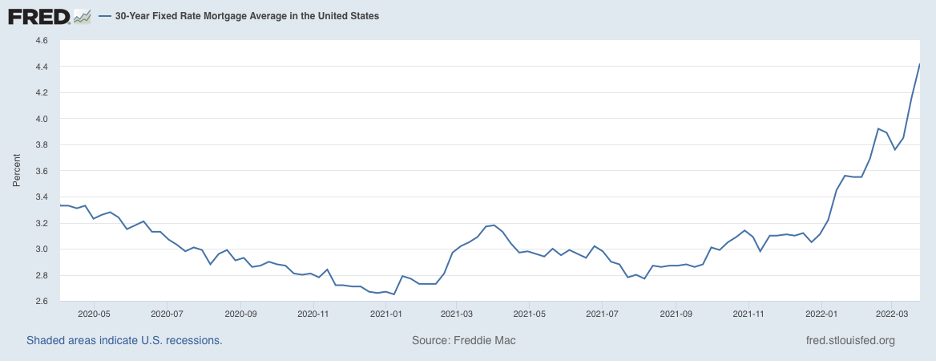

In 2022, mortgage rates have risen faster than even most economists were forecasting, with 30-year fixed rates ending last week averaging 4.95%. The rise in rates has exceeded 200 basis points since early 2021, impacting those on the margin more than any other segment of the housing market.

On a $400,000 loan, the difference between a 3% mortgage and a 4.5% mortgage is $340 per month to a potential homebuyer. And while many argue that the current rates, near 5%, are still low by historical standards, this difference in rate in such a short timeframe is a stinging shot to those entry-level homebuyers struggling to scrape together a down payment for their home purchase.

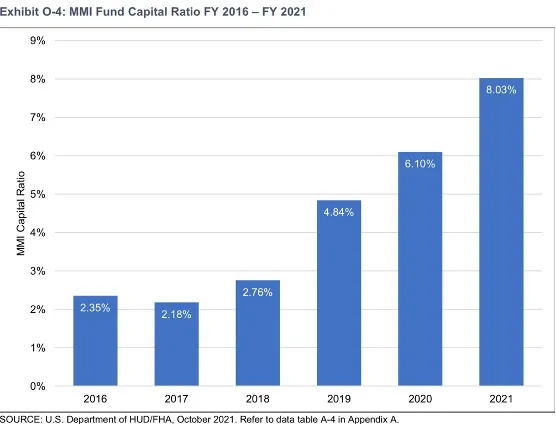

What’s surprising to me, as someone who served at HUD during the Obama administration, is that there is virtually no rationale in holding mortgage insurance premiums at the levels they are today considering the strength of the Mutual Mortgage Insurance Fund (MMI).

HUD Secretary Marcia Fudge noted this strength in her report to Congress in November, noting, “The actuarial study shows the capital reserve ratio of the MMI Fund is 8.03 percent as of September 30, 2021, an increase of 1.93 percentage points over the previous fiscal year. This increase is driven in large part by a housing market that endured the pandemic overall with strong home price appreciation nationwide, sustained low interest rates creating strong refinance volume, and positive financial performance of the HECM portfolio for the first time since 2015.”

An 8.03% capital reserve ratio is record-setting from a historical perspective.

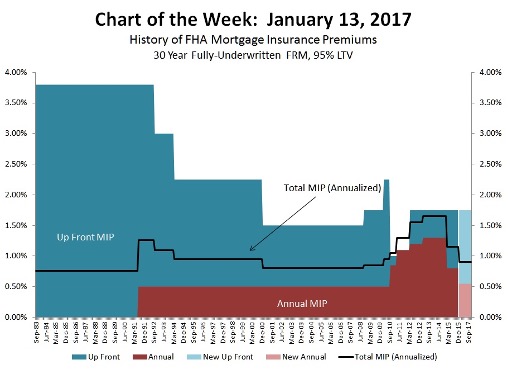

When I served as FHA Commissioner, beginning in 2009 I raised premiums several times. Initially only up front as FHA was capped on how much it could raise annual premiums and then, following legislative support from Congress, raising the annual and implementing the life of loan premium.

These moves were done because the fund was severely hurt by the great recession of 2008. But today, the environment is totally different and I cannot understand why the Secretary has not acted yet to lower premiums.

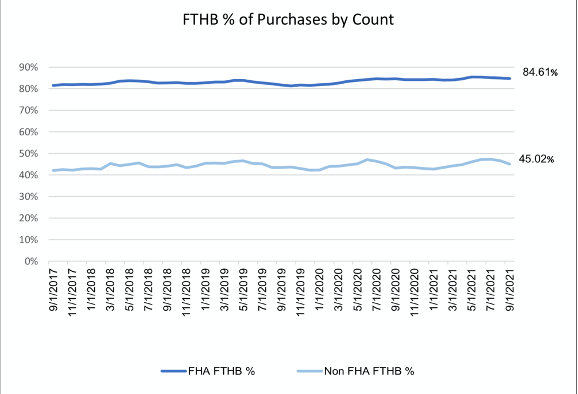

Secretary Fudge has testified and made speeches about wanting to help improve minority homeownership outcomes. In last year’s actuarial report, HUD trumpeted that, “FHA endorsements for mortgages made to Black and Hispanic borrowers are more than twice that of the rest of the market, according to Calendar Year 2020 Home Mortgage Disclosure Act data,” which only emphasizes the importance of this program to entry-level first-time and minority homebuyers.

In fact, FHA is the vehicle primarily used by first-time homebuyers, as shown in this chart (at right) presented to Congress last fall.

The executive team at HUD has gone to great lengths promoting more opportunity for minority homebuyers, attacking discrimination and implementing rules to enforce discrimination violations. This leadership has been important and well received by civil rights and community housing advocates. But keeping the fees this high and thus overpricing FHA borrowers, especially now with rates rising so rapidly, hits this same constituency right in the wallet and is impacting affordability.

Words are important, but actions matter more.

Reporting on a HMDA data release, Market Watch reported that, “In the second quarter of 2019, the Black homeownership rate dropped to 40.6%, down seven percentage points from roughly a decade earlier,” the lowest levels since the 1960s. The Urban Institute and other think tanks have written scores of white papers and research reports talking about the challenge of improving homeownership outcomes.

This is a crisis in housing access and opportunity and it’s time for HUD and the Biden administration to take action. Expanding opportunities for down payment assistance, looking at new methods to evaluate credit histories beyond FICO, getting some of the large banks back into the program, and making substantial progress in the housing supply challenge are all critical to this effort.

But the most simple and helpful move can be done right now with just the stroke of a pen by mortgagee letter. Lowering the MIP will lower payments and improve the qualification ability of the FHA borrower and would have an immediate positive impact at a very challenging time in the market cycle.

HUD needs to act now and lower the MIP. It’s long overdue and as a former FHA Commissioner in the last Democratic administration, and as one who had to raise premiums to secure the fund, I can state now unequivocally that this is a different time and action is needed.

The call is simple: lower the MIP and lower it now.

David Stevens has held various positions in real estate finance, including serving as senior vice president of single family at Freddie Mac, executive vice president at Wells Fargo Home Mortgage, assistant secretary of Housing and FHA Commissioner, and CEO of the Mortgage Bankers Association.

This column does not necessarily reflect the opinion of HousingWire’s editorial department and its owners.

To contact the author of this story:

Dave Stevens at dave@davidhstevens.com

To contact the editor responsible for this story:

Sarah Wheeler at swheeler@housingwire.com

The post Opinion: HUD needs to lower the MIP and do it now appeared first on HousingWire.