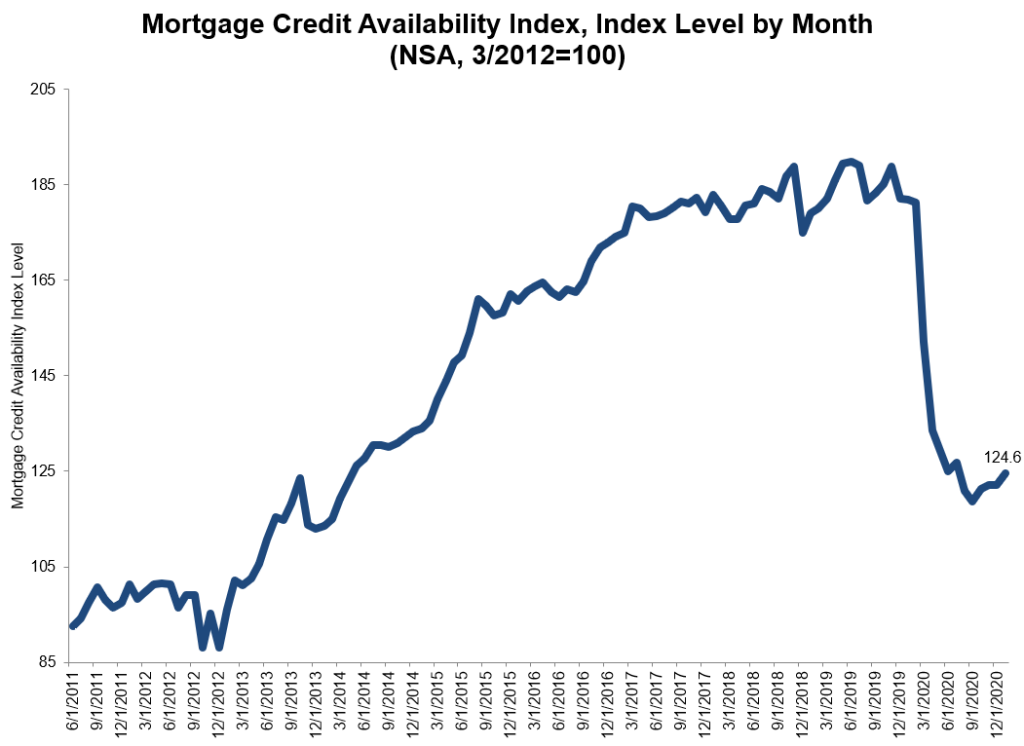

Mortgage credit is still the tightest it has been in more than six years, but steady loosening in January revealed lenders are preparing for a rebounding economy, the Mortgage Bankers Association said in a report on Tuesday.

The group’s Mortgage Credit Availability Index rose 2% to 124.6 last month, still hovering near levels previously seen in 2014, though it is the third month in the past four that credit availability has picked up as supply eases out. The index plunged from record highs seen in late 2019 after the COVID-19 pandemic caused the worst economic contraction since the Great Depression.

Measuring credit availability by loan type, the Conforming MCAI that tracks loans backed by Fannie Mae and Freddie Mac rose 7.7% while the Jumbo MCAI measuring high-balance loans rose 2.2%, and the Conventional MCAI that measures loans not backed by the government rose 4.8%.

The Government MCAI that includes mortgages backed by the Federal Housing Administration, the Veterans Administration and the U.S. Department of Agriculture fell by .1%, MBA said.

A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit.

What happens when borrowers have more control of the lending process?

FormFree is launching a blockchain-based exchange for consumers to take control of the mortgage lending process. The idea behind the distributed ledger technology is to provide faster close times and more choice for both loan seekers and lenders by giving consumers access to their own ATP.

Presented by: FormFree

According to Joel Kan, MBA’s associate vice president of economic and industry forecasting, an uptick in credit availability coincides with a housing market that is poised for a strong start to the year.

“Improvements were driven by the conventional segment of the mortgage market, as lenders added ARM loans with lower credit score and higher LTV requirements,” Kan said.

Despite ARM loans accounting for a very small share of loan applications in recent months, Kan noted lenders are likely looking ahead to a strong home buying season by expanding their product offerings.

And even with tighter standards throughout the pandemic, the lowest mortgage rates on record still pushed $4 trillion in originations, insane year-over-year compensation for LO’s and opened the gate for several lenders to finally go public in 2020.

Fannie Mae’s economic and strategic group also upgraded its 2021 forecast in January setting expectations higher for GDP, increased home sale growth in the beginning of the year and even more purchase originations than the year prior.

“Ongoing strength in home-purchase applications and home sales continue to signal robust housing demand, even as low housing inventory remains a constraint,” Kan said.

The post It’s still really difficult to get a mortgage, but getting easier appeared first on HousingWire.