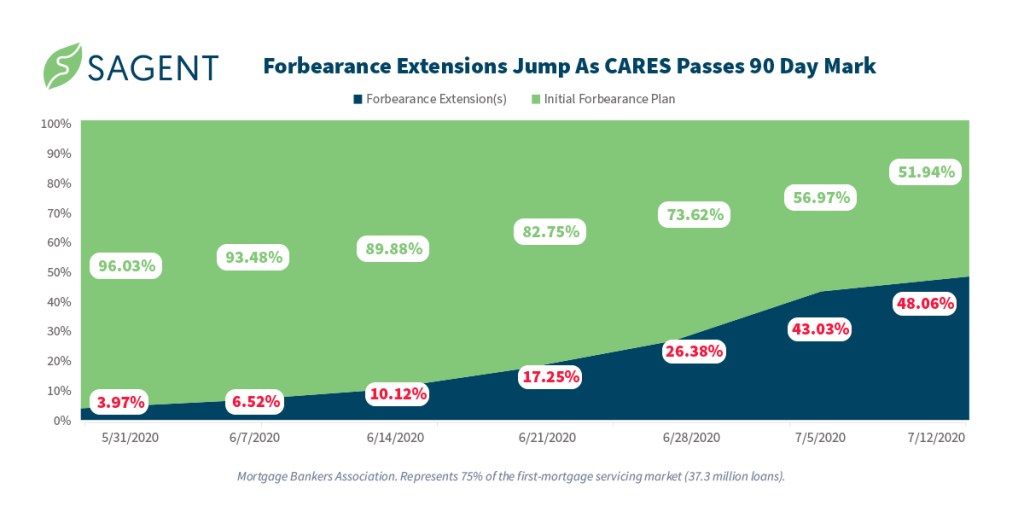

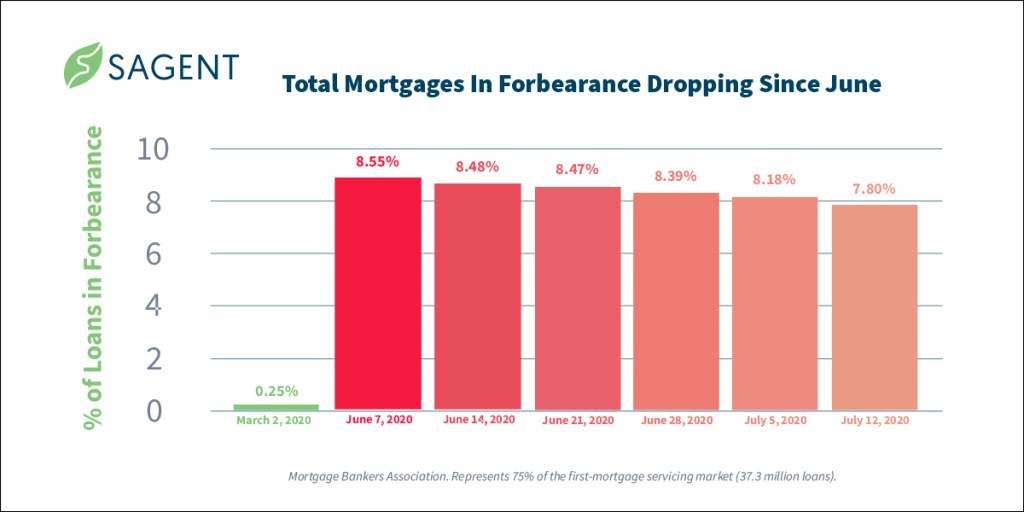

As mortgage forbearances dropped from 8.55% to 7.8% in the past five weeks, forbearances that received extensions jumped from 6.52% to 48.06%.

Is this a sign of trouble for homeowners and the economy? Let’s examine what’s driving this trend, key dates to watch next and how servicers can care for homeowners during this time.

Are forbearance extensions homeowner hardship or servicer practices?

Between June 28 and July 12, the percentage of loans in forbearance that got forbearance extensions jumped from 26.38% to 48.06% (see chart 1 below).

It’s no coincidence that this jump happened leading up to and through the 90-day mark after April 1, when the first massive wave of forbearances happened. Most servicers typically grant forbearances in 90-day increments.

Forbearances dropped every week the past month (see chart 2 below), so increasing forbearance extensions may not imply worsening homeowner strain. It may just mean many people needed a full six months to begin with – which the CARES Act allows – rather than just 90 days.

Smart servicers are using this 90-day check-in period to engage customers and educate them on their next set of options.

Two key dates to watch next as forbearances mature

Now that we’re three months past the first COVID-19 lockdowns that hit homeowners and consumers, here are the next key dates we’re monitoring to help servicers with homeowner education:

July 15: Weekly servicer call center volumes (as a percentage of portfolio volume) jumped a full 1.55% to 8.33% from the week ending June 28 to the week ending July 12. This coincides with July payments coming due as well as the forbearance extension spike. We must watch call center volume and forbearance extension data up to and through the July 15 monthly payment grace period date (data reflecting the July 15 grace period is released July 27).

August 1: This is the next payment due date for all mortgage borrowers in forbearance, and also the first day after the end of enhanced unemployment benefits. This date is critical because the decision to end benefits as planned could create major financial pitfalls for many homeowners. According to the latest DOL data, roughly 17.3 million people are currently receiving unemployment benefits, and 1.3 million new claims were filed as of July 11.

How servicers can prepare for whatever comes next

Longer forbearance periods, extensions and ever-changing regulations mean it’s more important than ever for servicers to have the right customer communication, care and engagement tools.

Sagent’s servicer-facing LoanServ and consumer-facing Account Connect tools have enabled servicers to configure (rather than code) for scale customer care and compliance during this very real-time crisis and policy response.

When COVID-19’s economic strain hit American homeowners all at once in March and April, our servicers were able to quickly add self-serve – using Account Connect – to their full-serve customer care, and also quickly adjust their systems using LoanServ to manage critical compliance and accounting functions as CARES and other forbearance and relief efforts came in real time.

This includes seamlessly evaluating and quickly approving forbearance extensions in this current phase of the cycle.

Sagent’s Washington team works closely with servicers to provide the most relevant insights as they happen

Things will continue changing in real time for the rest of 2020 and beyond. Outside of the factors we’ve mentioned above, additional lockdowns and a second government stimulus are two other things for which we are watching.

Sagent takes its responsibility to power servicers very seriously, and our Washington team will continue working with GSEs and regulators to provide accurate and timely information to servicers.

Servicers are the heroes on the front lines of the housing economy during this tough time, influencing positive outcomes for homeowners and the American housing system.

The post Is July’s forbearance extension spike a sign of trouble? appeared first on HousingWire.