Homebuyers with secure, high-paying jobs and access to cash and credit take advantage of low mortgage rates, as job losses disproportionately affect low-income and Black workers, already excluded from homeownership.

The impact of the coronavirus shutdowns on homebuyer demand has so far been short and muted, even in some of the cities that have been the hardest-hit by unemployment during the recession. This rapid recovery in demand is a strong indication that most people who were, and are, in the market to buy a home have escaped this recession relatively unscathed.

Although the current recession officially began in February, the biggest effects began in mid-March, when most of the nation shut down due to the coronavirus. Since then, people such as tech workers and those with other white-collar office jobs that can be done remotely, who have job security and access to cash and credit have been able to continue their home searches and take advantage of low mortgage interest rates. This group is largely white. On the flip side, people who have been struggling the most during this recession—those with low-income jobs in industries like service and hospitality, groups that are made up of much more Blacks and other minorities—had largely already been priced out of the housing market even before the economy stalled. Because of this inequality across incomes and industries, the pain of the coronavirus recession is likely to be over relatively quickly for the economically privileged, even in areas where unemployment has soared.

“With record-low interest rates and relative job security in spite of the recession, higher-income homebuyers are already coming back into the housing market,” said Redfin lead economist Taylor Marr. “Because of this quick bounce back in homebuying demand, this recession is playing out very differently than the Great Recession, and we’re not seeing much impact on home prices so far.”

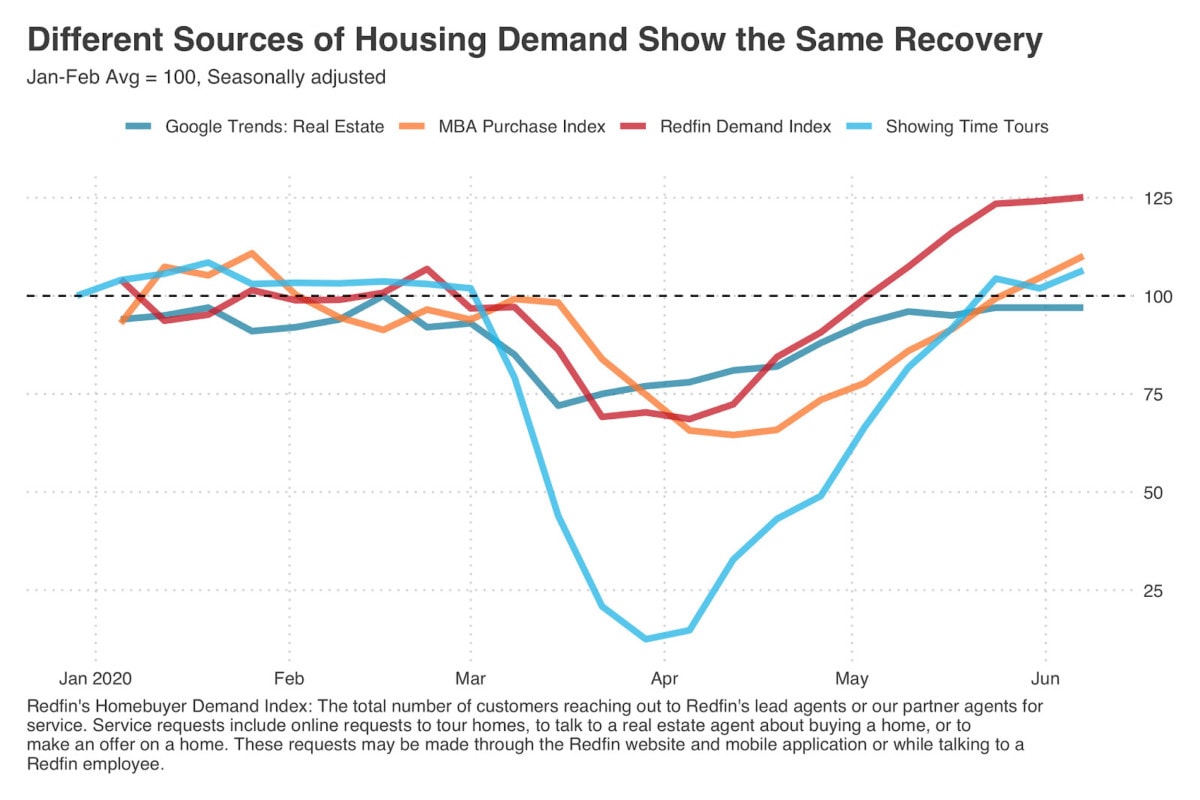

Although Redfin’s measure of homebuying demand (i.e. customers requesting home tours, making offers, or asking to connect with a real estate agent) rapidly collapsed when the coronavirus shutdowns first swept the nation in March, as of early June national demand was 25% higher than the pre-coronavirus period. The same trend can be seen in other measures of housing demand such as Google Trends search data, the Mortgage Bankers Association’s purchase index, and home touring data from ShowingTime.

“With the rapid increase in housing prices over the past several years, it’s been increasingly difficult for many Americans to afford the American dream,” explained Redfin Chief Growth Officer Adam Wiener in a recent weekly demand report. “With job losses disproportionately affecting people with lower incomes, unemployment hasn’t had much effect on homebuying demand, yet.”

What’s Driving the Rebound in Homebuying Demand?

Homebuyer demand has been recovering in nearly every city, even those with the highest levels of unemployment. The strongest comeback has been in Detroit, where the April unemployment rate was nearly 25%.

“Homebuying demand came back in Detroit as soon as shelter-in-place restrictions were eased for real estate agents on May 7th,” said Redfin Detroit market manager Michael Garliauskas. Local Redfin agent Scott Goleniak agreed. “When this all started I truly thought it would shut down the real estate market, but that was far from what happened in Detroit.”

Detroit Redfin agent Tony Orlando added that “people who are still employed and confident in their continued employment still really want to buy. They know rates are at historic lows and they want to take advantage of it; they are not afraid to buy during these odd times. Buyer demand is insane here, and nearly every home is a multiple offer situation. Of about 12 offers I have written over the past 10 to 12 days at price points between $200,000 and $700,000, all but two were multiple offer situations. It is astonishing.”

Homebuyer Demand Recovery by Metro Area

| Metro Area | Change in Redfin Homebuyer Demand Index, Week of May 31 vs. Week of March 1 | April Unemployment Rate |

|---|---|---|

| Detroit, MI | +58% | 24.4% |

| Seattle, WA | +48% | 16.7% |

| San Francisco, CA | +38% | 13.2% |

| Boston, MA | +30% | 15.4% |

| Las Vegas, NV | +25% | 33.5% |

| Miami, FL | +24% | 13.2% |

| Riverside, CA | +22% | 14.4% |

| San Diego, CA | +21% | 15.0% |

| Tampa, FL | +19% | 13.1% |

| Los Angeles, CA | +19% | 18.8% |

| Atlanta, GA | +12% | 12.7% |

| Denver, CO | +10% | 12.1% |

| Houston, TX | +9% | 14.2% |

| Minneapolis, MN | +7% | 9.2% |

| St. Louis, MO | +7% | 11.0% |

| New York, NY | +4% | 15.1% |

| Chicago, IL | +4% | 17.5% |

| Phoenix, AZ | -0% | 12.3% |

| Washington, D.C. | -1% | 9.9% |

| Dallas, TX | -2% | 12.8% |

| Philadelphia, PA | -2% | 14.5% |

Cities such as Seattle and San Francisco that are flush with high-tech jobs and relatively lower unemployment rates are also seeing a strong recovery. Redfin’s homebuyer demand has bounced back to over 35% above its pre-coronavirus levels in both of these tech towns.

“The market doesn’t feel like it’s skipped a beat to me,” said Seattle area Redfin agent David Hokenson. “There were just a few weeks where the market stalled and people were scared, but now it’s already back to normal.”

In New York, homebuying demand has not recovered as strongly as it has in other places, likely because it was one of the worst-hit places by COVID-19, which is leading to an increase in migration away from the city. Redfin agents in areas that are popular destinations for people looking to escape New York are already seeing signs of this shift.

“Old New York is looking in Connecticut,” said Connecticut Redfin agent Mike Dusiewicz. “It feels like no one wants to look in New York City anymore. They are moving out to Long Island, Connecticut, Hudson Valley and New Jersey. I’m working with a lot of buyers from New York who were planning to move to the suburbs in two to three years, but the pandemic has sped up the process for them.”

The Haves vs. the Have-Nots

The trend we’ve seen in homebuying demand over the past two months is an exacerbation of the inequality in the housing market over the past decade. The housing market has mostly been driven by white households with higher incomes—households less likely to have been severely affected economically by the coronavirus shutdowns. One way to see this is in the data from a May Federal Reserve employment survey, which shows that the unemployment rate for those at the top of the income spectrum ($100,000 and above) was 10%, less than half of the 21% rate among those at the bottom end who are making less than $60,000.

| Income Range | Share of Labor Force | Unemployment Rate |

|---|---|---|

| Under $60,000 | 34% | 21% |

| $50,000 to $99,999 | 26% | 13% |

| $100,000 and above | 40% | 10% |

In addition to the disparity in unemployment across income brackets, there is a large racial gap, which can be seen in the May unemployment data from the Bureau of Labor Statistics. The outsized impact of this recession on Black families is just the latest in a long string of inequities including segregation, redlining, and home lending discrimination that continue to impede their ability to build wealth. Even before the current surge in joblessness, the unemployment rate for Black families was three points higher than the rate for white families. Now that difference has doubled to six points.

| Race | May Unemployment Rate |

|---|---|

| Overall | 13.3% |

| non-Hispanic White | 10.7% |

| Black or African American | 16.8% |

| Asian | 15.0% |

| Hispanic | 17.2% |

This disparity highlights the need for serious action to address systemic racial inequality in housing and the economy as a whole. Unless the government takes aggressive, proactive steps to counteract the unequal impact this recession is already having on Black families, it is likely that the homeownership and wealth gaps will increase even more, continuing the pattern that followed the Great Recession.

Most and Least-Impacted Industries

The industries experiencing the worst unemployment were mostly those with lower wages such as service, hospitality, and retail. People working at bars reported a 60.6% unemployment rate in April. Hotels saw 48.7% unemployment, and the unemployment rate at restaurants was 34.8%. Because of this, the local economies in metro areas like Las Vegas that have large concentrations of people who have been hit the hardest are likely to see more of a lasting impact from this recession.

In contrast, some of the best-paying industries have barely seen an increase in their unemployment rate. The banking industry had just a 2.9% unemployment rate in April, while securities (3.4%) and “computer systems design” (i.e. software developers), (4.2%) were also among the least-impacted industries. Meanwhile, tech stocks have been hitting new highs throughout the pandemic, further lining the pockets of their well-paid workforce, whose compensation often includes large stock grants. As a result, areas like San Francisco and Seattle are likely to see a return to overall economic expansion much sooner than cities like Las Vegas.

Even within a single market, the disparity between the haves and the have-nots is becoming very clear. In the midst of the pandemic, Phoenix-based Redfin agent Kelly Khalil has been working with a client from Chicago who is buying a second home. “They aren’t planning on retiring for two more years, but they want to buy their retirement home early to take advantage of what they feel is a low market,” explained Khalil. “On the other hand, there are parts of Phoenix that have been hit really hard due to the total shutdown of tourism. We’re seeing a lot of homes that were formerly rented on Airbnb hitting the market. I have one client who had three in the same neighborhood but has now begun to sell them because they can’t afford to pay four mortgages without the rental income.

The great injustice of this recession is that it is likely to have deeper and longer-lasting impacts on the people who were already struggling. Those who were well-off and have maintained job security throughout the worst of the shutdowns are already practically back to business-as-usual, which is leading to a rapid recovery in homebuying demand.

The post Homebuying Demand Rebound Amid Coronavirus Recession Highlights Wealth Divide appeared first on Redfin | Real Estate Tips for Home Buying, Selling & More.