Growth in list prices is down 3 percentage points since the end of August, but pending sales were still up 30%

Key housing market takeaways for 434 U.S. metro areas during the 4-week period ending September 27:

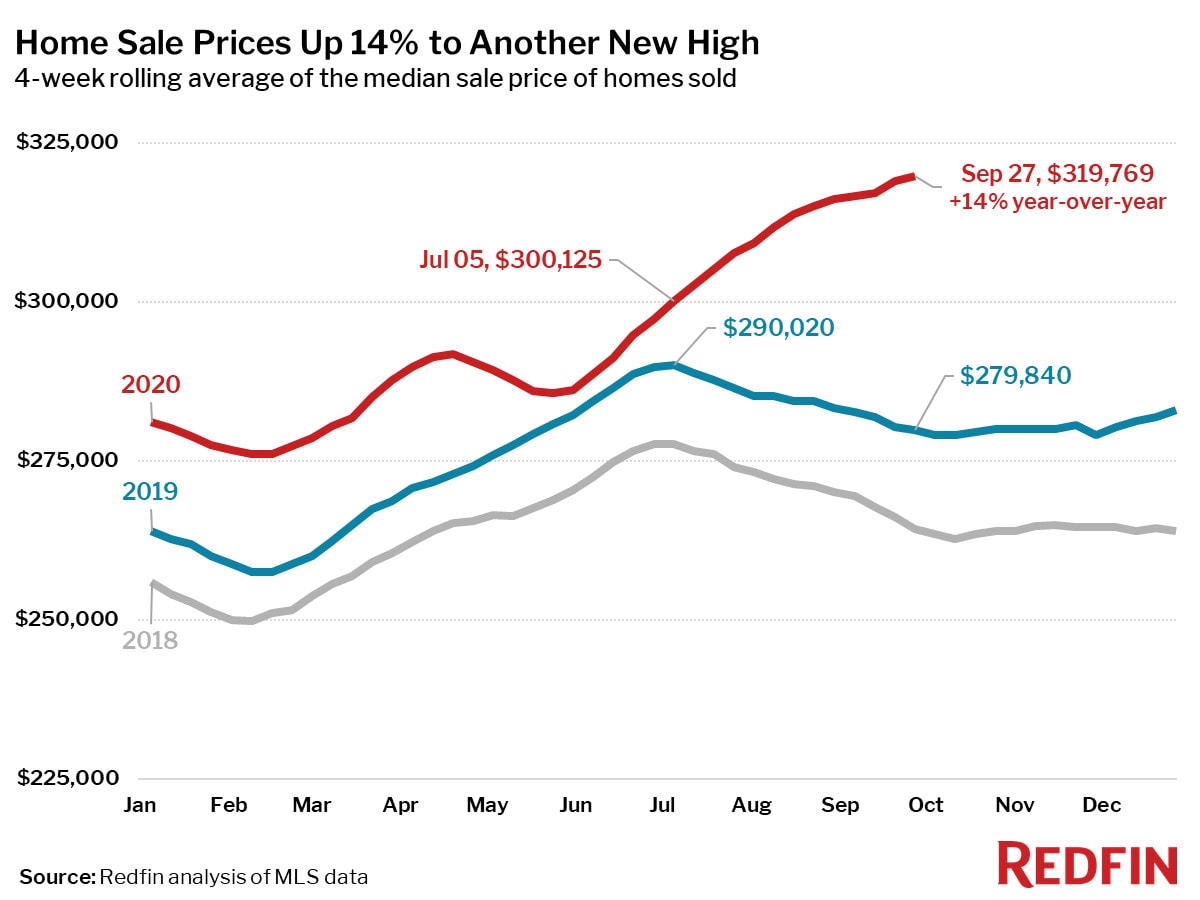

- The median home sale price increased 14% year over year to $319,769—the highest on record. The 14% jump was the largest since August 2013. Since the four-week period ending July 5, home prices have increased 6.5%. Over that same period in 2018 and 2019, prices declined an average of 4.2%.

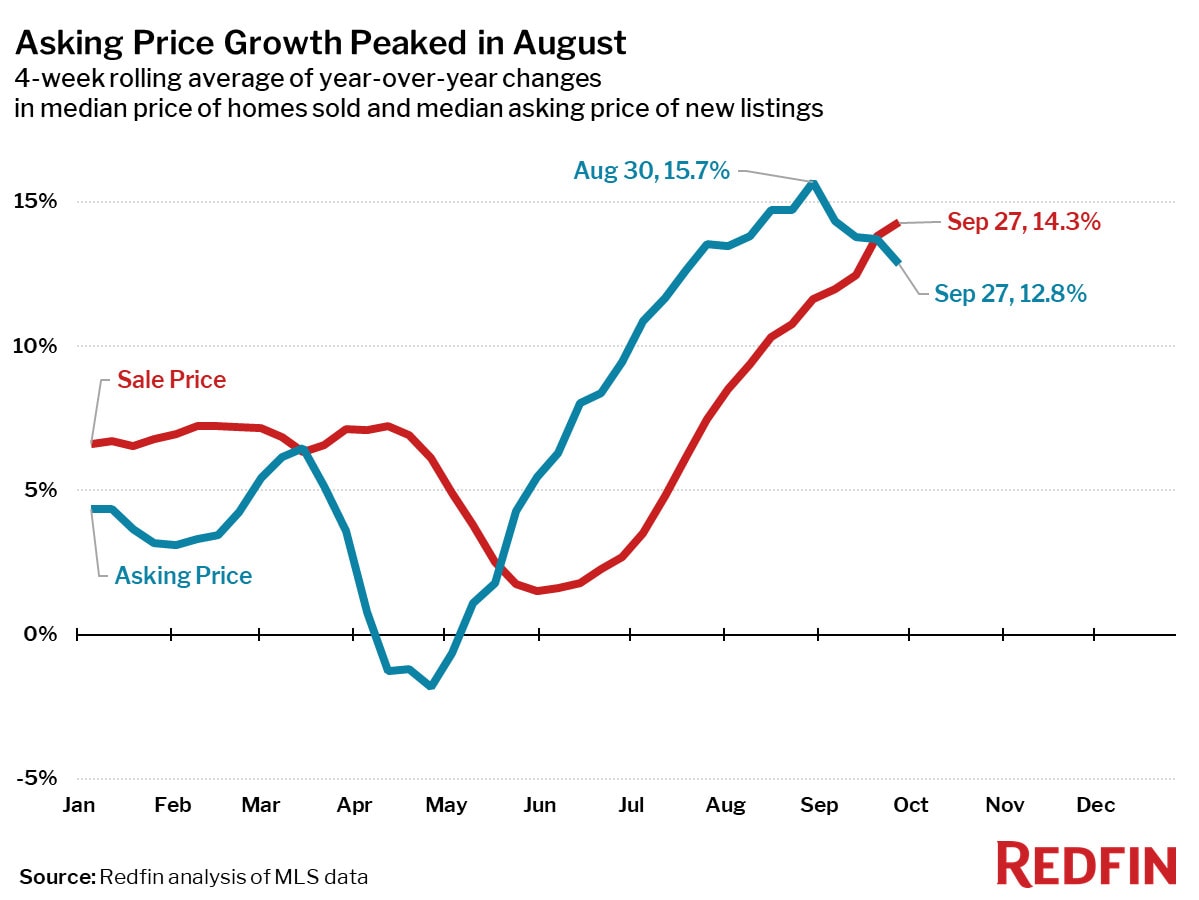

- The median asking price of new listings was up 12.8% from a year earlier. This growth rate has been declining since the four-week period ending August 30, when it peaked at 15.7%.

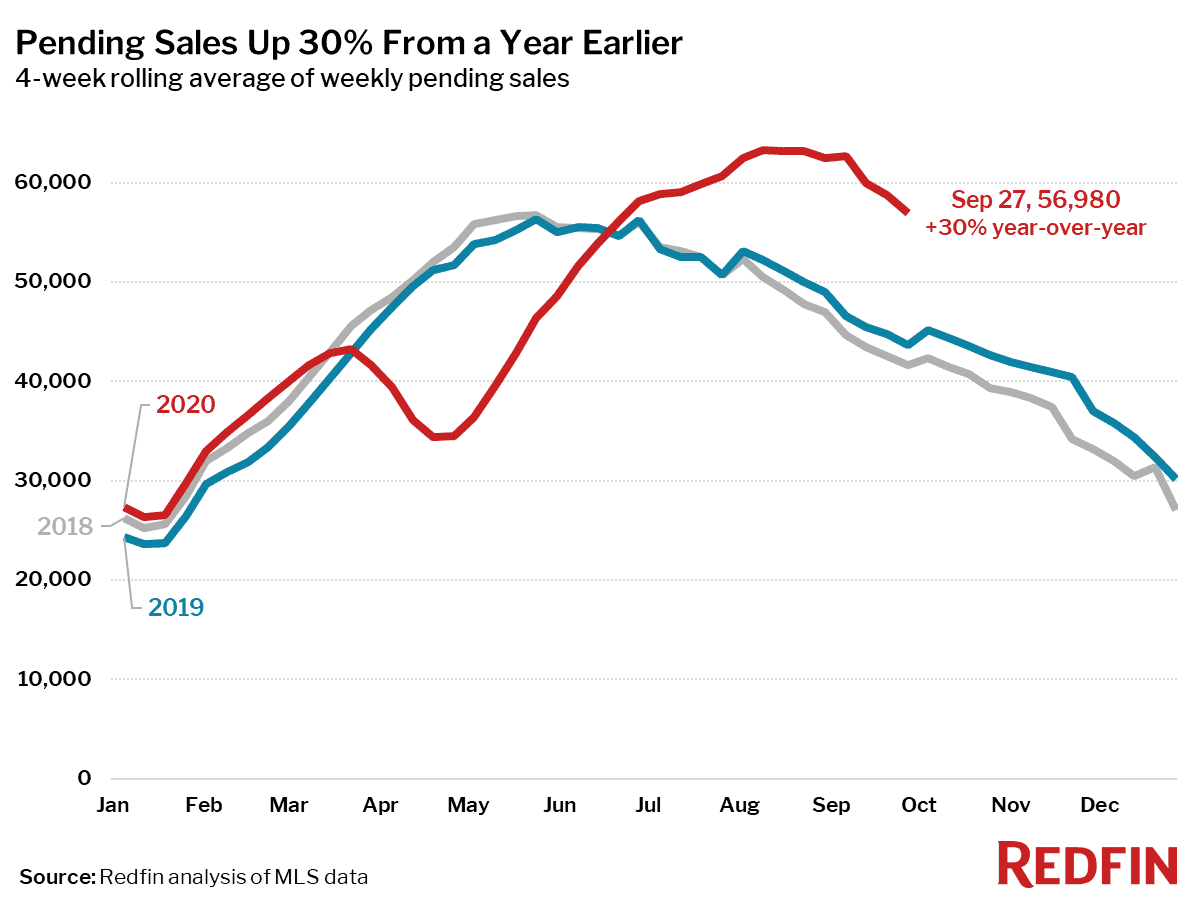

- Pending home sales climbed 30% year over year.

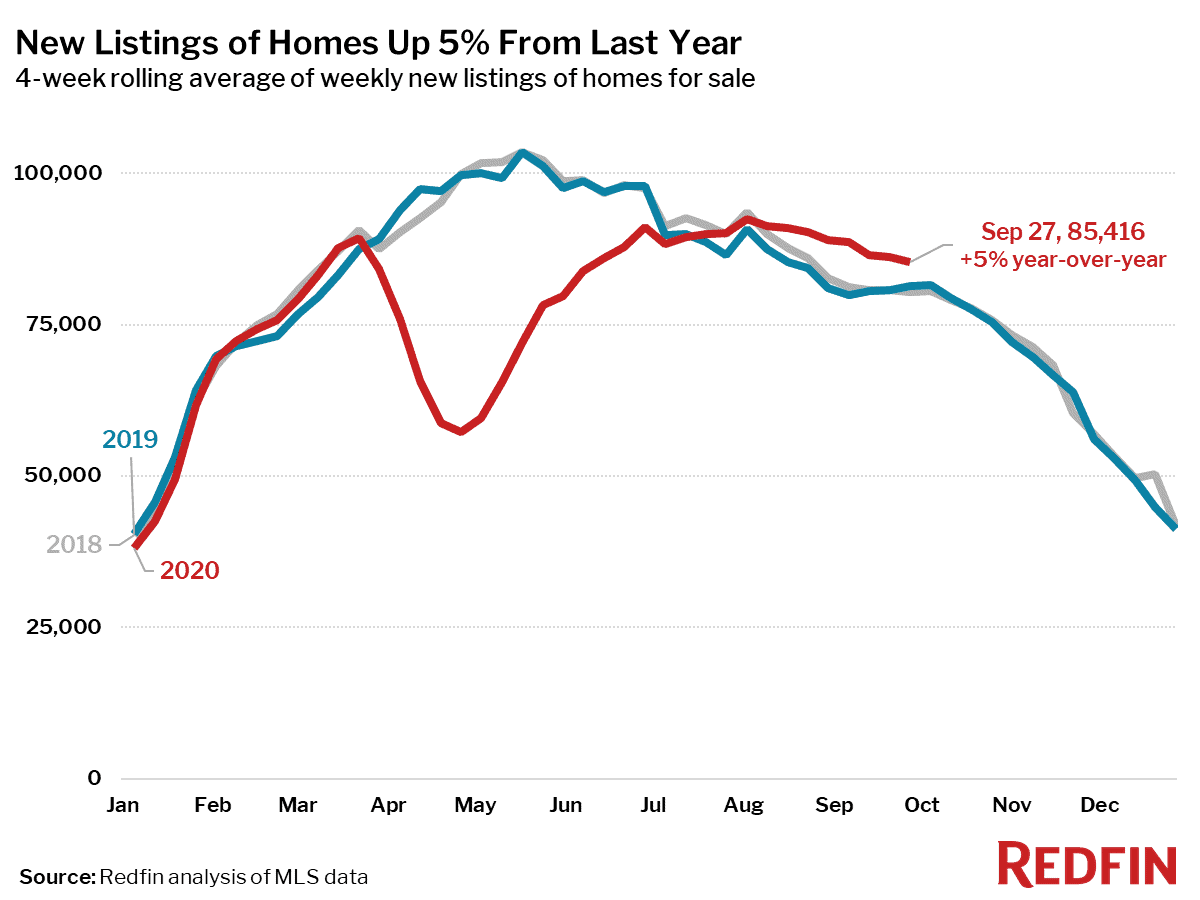

- New listings of homes for sale were up 5% from a year earlier. Year-over-year growth in new listings have been above 5% since the four-week period ending August 16.

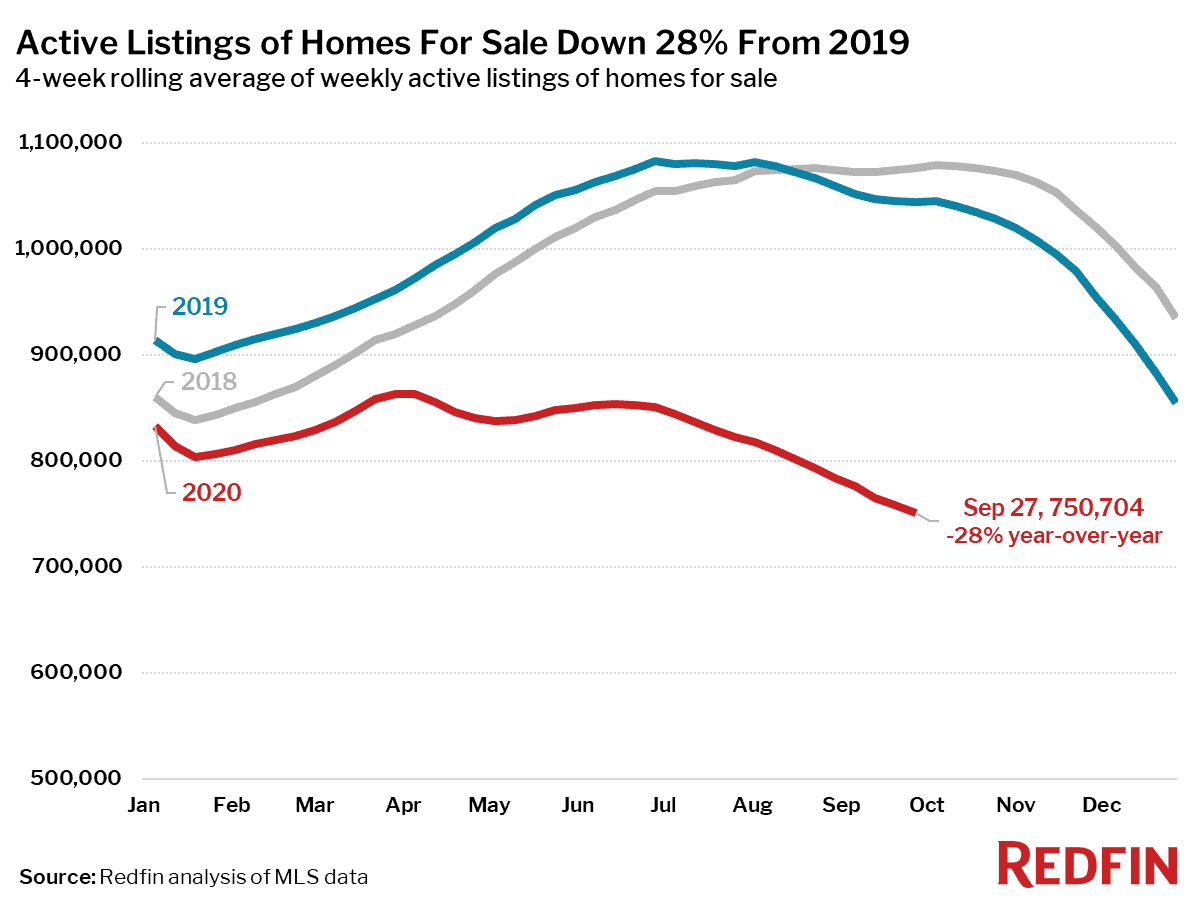

- Active listings (the number of homes listed for sale at any point during the period) fell 28% from 2019 to a new all-time low. The rate of year-over-year supply declines has remained consistent at this level for the past few months.

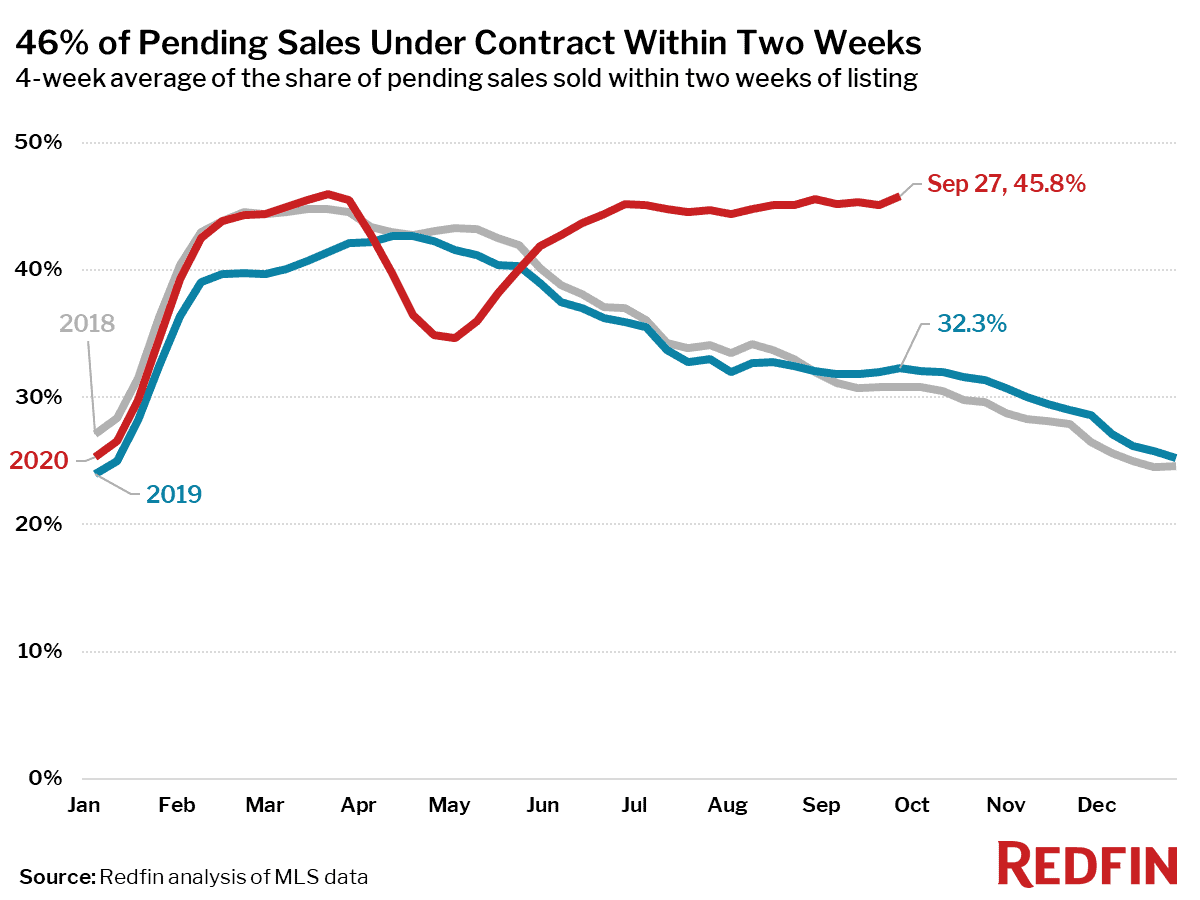

- 45.8% of homes that went under contract had an accepted offer within the first two weeks on the market. This has also held relatively steady for the last 17 weeks.

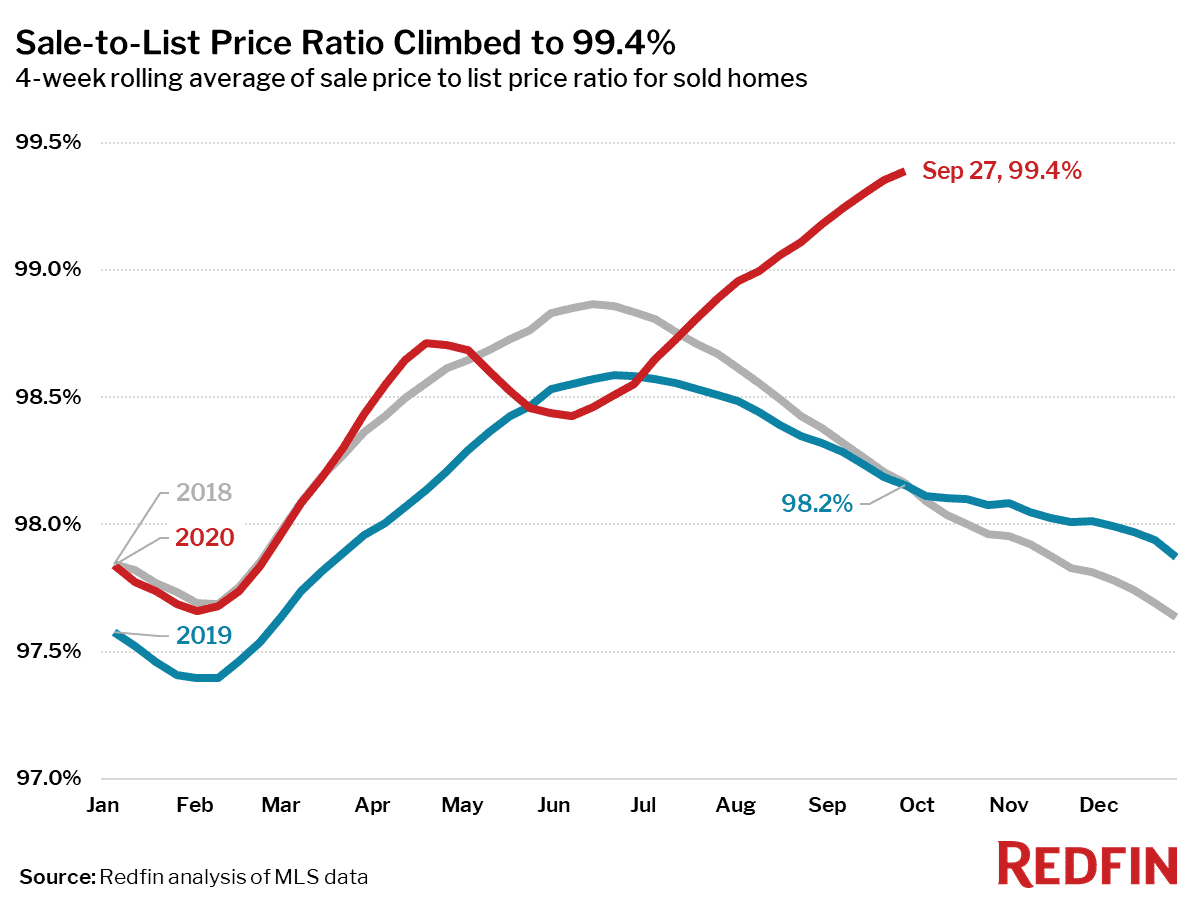

- The average sale-to-list price ratio, which measures how close homes are selling to their asking prices, rose to 99.4%—an all-time high and 1.2 percentage points higher than a year earlier.

- For the week ending September 27, the seasonally adjusted Redfin Homebuyer Demand Index was up 34.8% from pre-pandemic levels in January and February.

- Mortgage applications decreased 2% week over week during the week ending September 25. For the week ending October 1, 30-year mortgage rates fell to 2.88%. Rates have been below 3% since late July.

“The question on everyone’s mind is ‘how fast can prices keep rising?’,” said Redfin chief economist Daryl Fairweather. “Although the housing market is still red-hot, there are some early signs we may be nearing peak price growth. Sellers’ asking prices are still up significantly from last year, but by a lower rate than they were growing during the summer. Mortgage applications are also beginning to wane, and more new listings are coming onto the market. This is likely to be as good as it gets for home sellers, who definitely have had it very good for a very long time.”

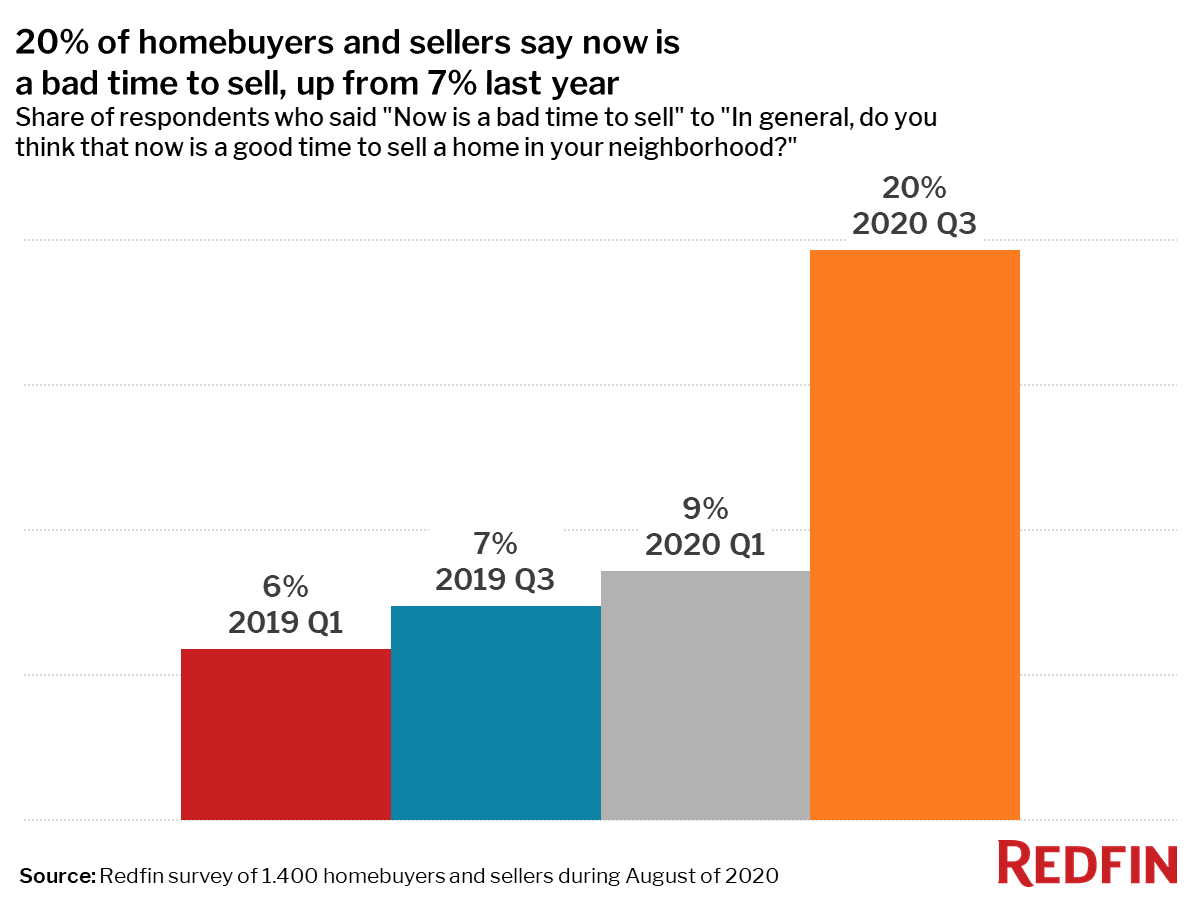

Lack of strong growth in new listings is likely a direct result of the ongoing pandemic. In a recent survey of over 1,400 homebuyers and sellers, 20% of respondents said that now is a bad time to sell a home, up from just 9% in the first quarter of the year. In the same survey 38% of home sellers said that they have health or safety concerns due to the coronavirus pandemic, compared to just 8% of homebuyers who cited coronavirus as a concern.

The post Home Prices Up 14%, But Price Growth May Wane Soon appeared first on Redfin | Real Estate Tips for Home Buying, Selling & More.