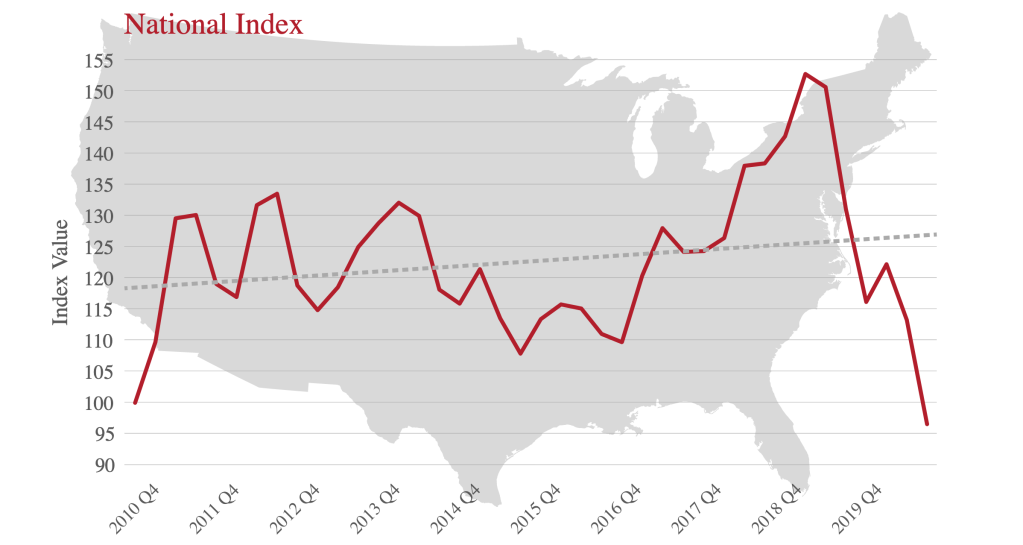

In its annual Mortgage Fraud Report, CoreLogic found that the risk of mortgage fraud for the 12 months ending June 2020 decreased 26.3% year-over-year nationally. Applications for investment properties showed the highest risk, while VA-based programs showed the lowest.

The recently released report is the industry standard for nationwide fraud monitoring and analysis and draws on its proprietary Mortgage Fraud Consortium Database, which includes over 100 million loan files.

The large drop in fraud risk can primarily be attributed to the increase in low-risk refinance transactions. Rate and term refinances have a single benefit – a lower payment. No new cash is available through the loan so there are fewer fraud scenarios that are possible. The most likely scenarios you may see during a refinance are attempts at hiding a recent job loss or falsified occupancy – “fraud for property” motives.

Nationally, most fraud types showed decreased risk; however, occupancy fraud risk showed an increase of 25.8% year-over-year. All refinance segments decreased year-over-year with government-based refinances having the lowest risk levels.

Purchase transactions had an overall 6% increase in risk. Jumbo purchases were the one purchase segment that showed less risk, with a 26% risk decrease amid declining volume. This may be due to tighter lender guidelines for jumbos as markets responded to COVID-19 and forbearance risks.

During the second quarter of 2020, one in 164 mortgage applications were estimated to have indications of fraud – broken out by purpose, one in 126 purchase applications and one in 200 refinance applications showed indications of fraud.

The highest-risk applications for both the purchase and refinance populations were for investment properties. CoreLogic’s report found that investment purchase applications showed the highest risk, as 1 in 28 applications were estimated to have indications of fraud.

Investment purchases had a 74% increase in risk despite lower volumes and tighter lending guidelines, reflecting a new high in the history of CoreLogic’s index.

“Investment loan applications are showing a higher risk because real estate investors have a profit motivation for their activity,” said Bridget Berg, Principal, Fraud Solutions at CoreLogic. “This introduces other factors and increases the risk compared to a purchase for personal use. Investors often own other real estate and are more likely to have undisclosed ownership and transactions in process.”

VA-based programs had the lowest-risk applications, CoreLogic found. According to Berg, this is because VA loans are restricted to a select group of borrowers and, with the exception of certain refinances, they are for personal occupancy.

“This makes identity issues and straw buyer situations rare,” she said. “Many VA borrowers are employed by the military, reducing income risk also.”

The top five states for overall mortgage application fraud risk were New York, Nevada, Florida, Hawaii and Maine. New York and Florida showed risk decreases in the last year while Nevada is in the top three for the first time since 2014, with a year-over-year risk increase of 8%.

The top five states showing increases in fraud risk were New Hampshire, Wyoming, North Dakota, Nevada and Rhode Island. CoreLogic’s findings noted that less populous states are more volatile due to lower levels of lending activity.

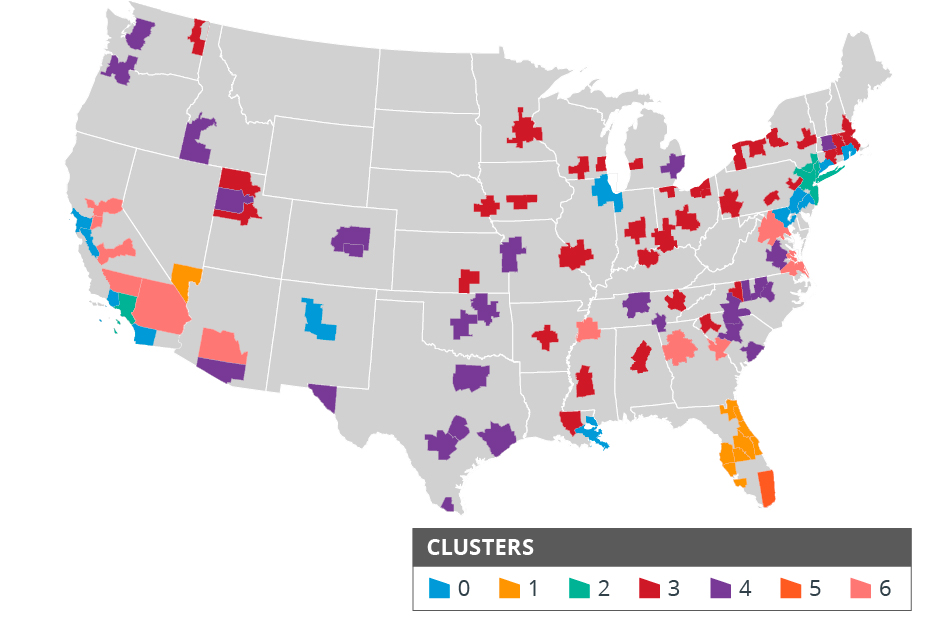

As part of its new focus on core-based statistical area (CBSA) clusters, the CoreLogic Science and Analytics team looked at the fraud data and pooled geographies with similar patterns and rates of change in fraud risk. Fraud trends may include a geographic component, with the conditions that create opportunities for specific fraud schemes in one area repeating in other, similar areas.

The analysis identified seven CBSA clusters, which may help risk managers identify areas to target when investigating fraud schemes. As part of its analysis, CoreLogic noted the following:

- Miami, often the highest-risk CBSA, stands alone and no other CBSAs closely mirror it.

- Central Florida, which is historically at high risk of mortgage application fraud, behaves more similarly to Las Vegas than to Miami.

- Los Angeles, New York City, and Poughkeepsie, New York, form a cluster but the areas surrounding them are in different clusters.

- Chicago, San Francisco, San Jose, Philadelphia and Albuquerque have similar patterns of fraud risk.

CoreLogic’s Mortgage Fraud Report analyzes the collective level of loan application fraud risk experienced by the mortgage industry each quarter. The report, based on residential mortgage loan applications processed by predictive scoring technology CoreLogic LoanSafe Fraud Manager, includes detailed data for six fraud type indicators that complement the national index: identity, income, occupancy, property, transaction and undisclosed real estate debt.

The segments and indices included in the report have been updated recently. In 2019, CoreLogic created the new Fraud Risk Score Model 4.0, with more granular segmentation to highlight the most relevant fraud risk differences between loan programs. This year, the company launched a new generation of fraud indices to leverage this new model and better control for volatility.

“Our investment into the new model and indices allows for more precise analysis across the consortium, bringing new insights to keep advancing early identification of fraud patterns with fewer false positives,” said Fabien Huard, Senior Leader, Science and Analytics.

For more detailed data and analysis, view the 2020 CoreLogic Mortgage Fraud Report here.

The post Amid record-high origination volumes, mortgage fraud risk is down – Here’s why appeared first on HousingWire.