Key takeaways for the 4-week period ending July 26:

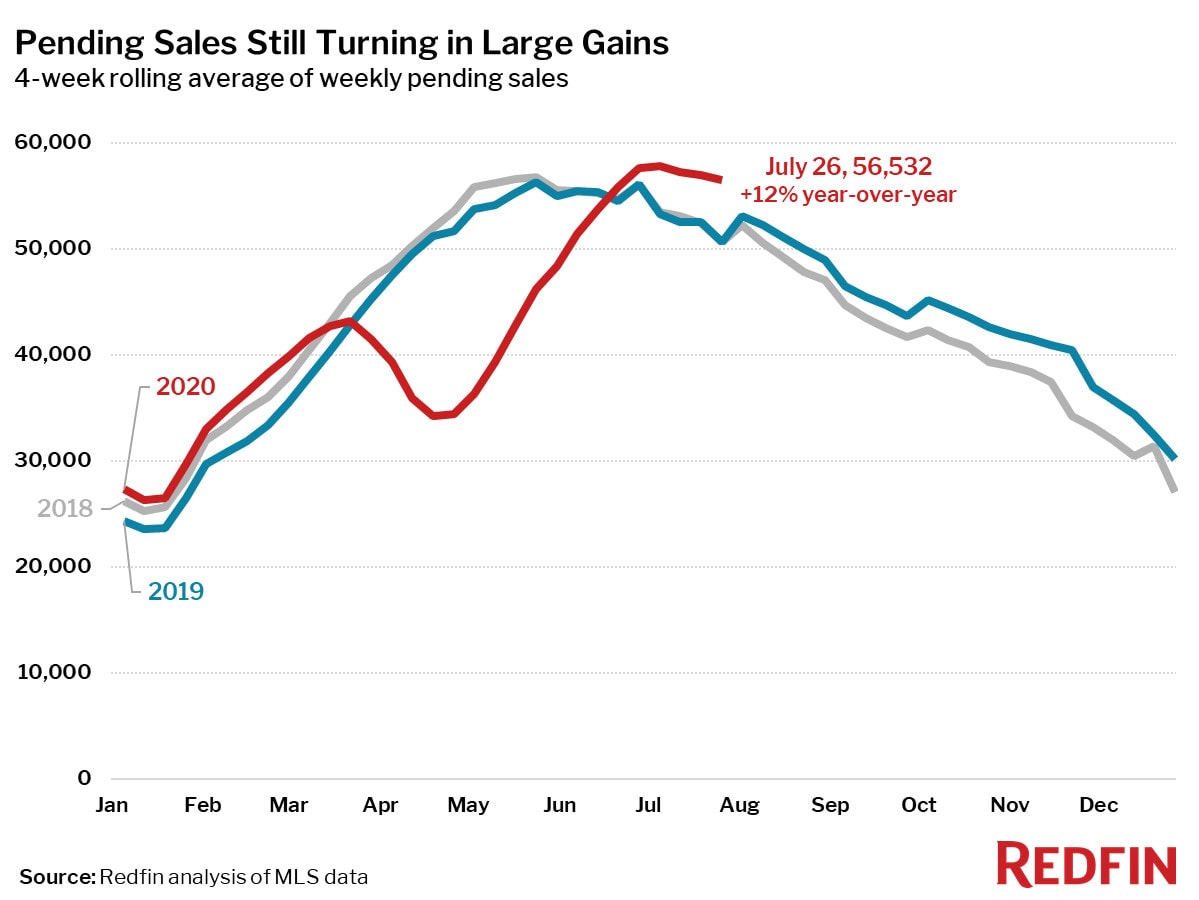

- Pending home sales were up 12% year over year, an increase from the 7% year over year gains we reported for the period ending July 12.

- 30-year mortgage rates have hovered around 3% for three weeks, and mortgage purchase applications were up 21% from a year earlier.

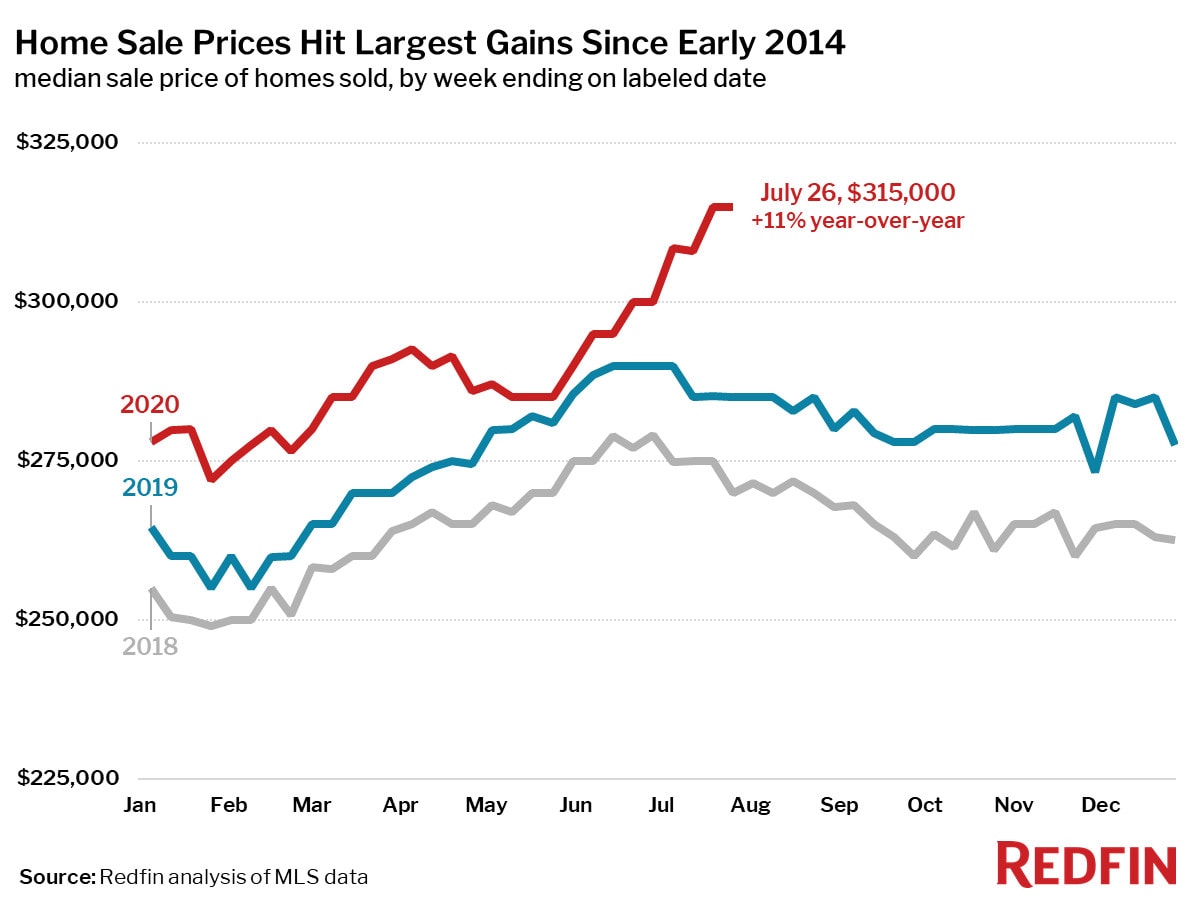

- Home sale prices were up 11% year over year for the week ending July 26, the largest increase since 2014.

- For homes actively listed during the period, asking prices were up 14% year over year and may have peaked for 2020.

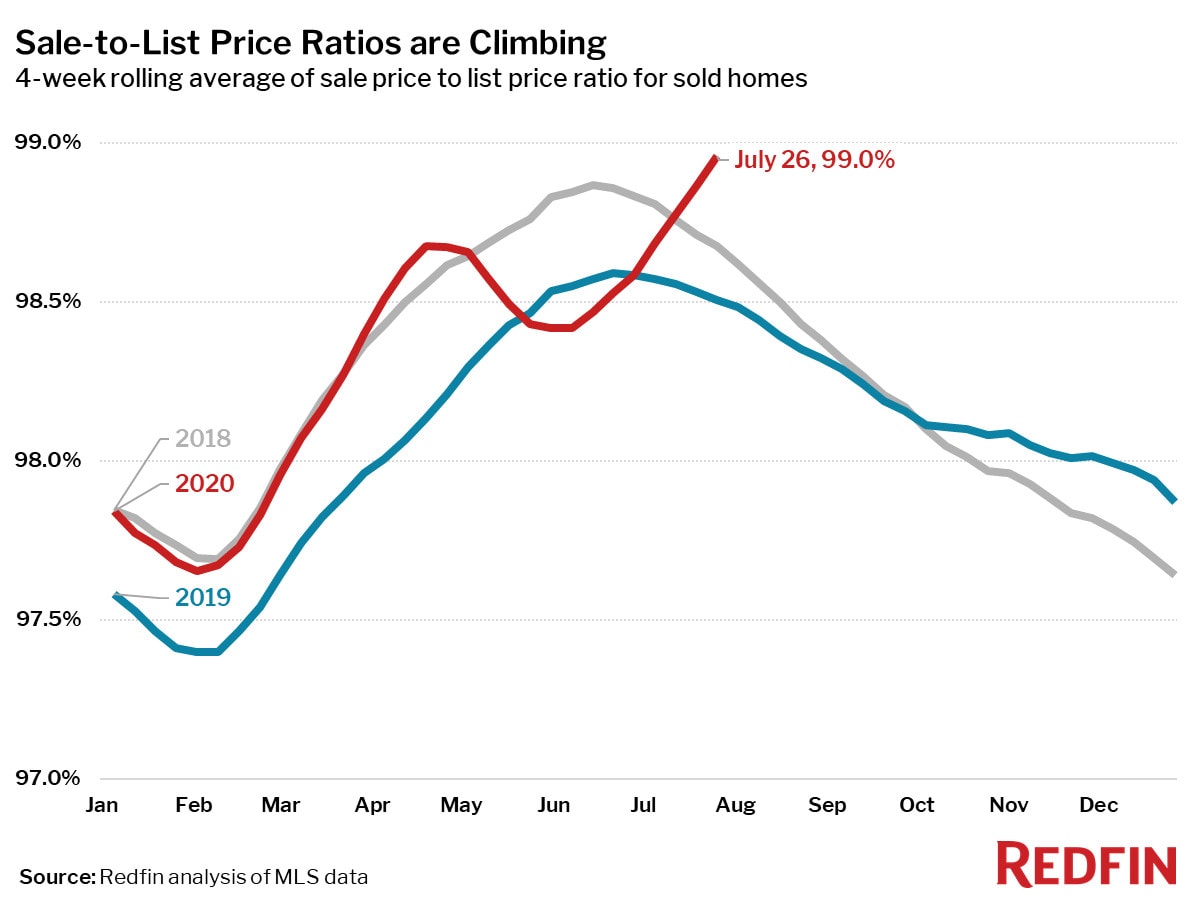

- The sale-to-list price ratio, which compares the final sale price to the list price, rose to 99.0%—the highest level since at least 2012 (as far back as our data on this measure goes).

- The supply of homes for sale continued to fall short of demand, as new listings were down 0.7% year-over-year and active inventory of homes for sale was down 30%. “A lot of people are living with family and friends now because it’s too hard to enter the market,” said Salt Lake City Redfin agent Campbell Dosch.

Pending home sales still turning in strong gains

The U.S. housing market continued to see strong demand from homebuyers for the four-week period ending July 26. The seasonally-adjusted Redfin Homebuyer Demand Index was up 27% from pre-pandemic levels in January and February. Pending home sales were up 12% compared to a year earlier, driven by mortgage rates that remain near historic lows.

One factor spurring strong pending sales and keeping sales from declining more quickly may be buyers who delayed purchasing in the spring now rushing to buy before school starts in the fall. “School districts are still important even with the uncertainty of everything that has happened this year,” added Salt Lake City Redfin agent Campbell Dosch. “Homebuyers are focused on the fact that we’ll eventually overcome this, it’s not going to be forever, so finding a home with highly rated schools is still important to them.”

Price gains hit double digits

The median asking price of homes for sale stabilized in the last four weeks, and remained up 14% from a year earlier. Even as list prices turn in double-digit growth from 2019, buyers are still paying up. The median price of homes that sold during the four-week period ending July 26 was up 9% year over year. For just the week of July 20-26, the median sale price climbed 11% year over year to $315,000—a record high. This was the largest increase in sale prices recorded since early 2014.

“One of the first things I have to do with many of my buyers here in Houston is educate them on the reality that many houses are selling for more than asking,” explained Houston Redfin agent Melanie Miller. “You can’t wait around for a price drop. Rather, homes that are priced right are receiving offers at or above full price within three days of being listed, so serious buyers need to be ready to act quickly.”

Indeed, the average sale-to-list price ratio (which compares the final sale price to the list price) also rose to the highest level in at least eight years, hitting 99.0% during the four-week period. Redfin’s data on this measure goes back through 2012.

Homes for sale: Where’s the beef?

Despite all of this strength in home prices and still-strong demand from homebuyers, home sellers are still rarer than they have been in any recent year. New listings were down 0.7% year over year for the four-week period ending July 26, and active inventory of homes for sale was down 30%.

“The shortage of homes for sale makes people think ‘maybe I should wait until things get cooler’, but unless we start to see a huge surge of new listings, things aren’t going to cool down much,” said Dosch. “Even new construction is selling out faster than it is being built. The shortage has extended into rentals too. A lot of people are living with family and friends now because it’s too hard to enter the market.”

“Some buyers I’ve worked with recently are tired of losing out on multiple offers,” said Houston Redfin agent Melanie Miller. “I’ve suggested that they consider waiting for the fall, after the pent-up rush from buyers who need to move in time for the new school season.”

Changes could come now that July is over

While the year-over-year comparisons of homebuying demand have only gotten stronger, there’s some evidence we may have passed the summer peak in pending sales. Pending sales have slowed very slightly week-over-week for the past three weeks and are now about 2% lower than they were for the week ending July 5. That’s less of a dip than we’d normally expect to see from the first week of July to the last, but it’s a trend we’ll continue to watch in the upcoming weeks.

The bigger potential issue for the market is expiration of the enhanced unemployment benefits that were passed as part of the CARES Act. Although the housing market has so far been one of the most resilient parts of the U.S. economy, that strength is now facing a test as so far there is no agreement on whether or how to extend them.

“The economic pain of the pandemic has so far mostly been borne by those with lower incomes who were not as likely to be participating in the for-sale housing market,” said Redfin chief economist Daryl Fairweather. “However, the expanded unemployment benefits being given to these workers has helped to keep the overall economy on stronger footing during a very uncertain time. One example of this is that the money has helped boost retail sales back to pre-pandemic levels. Without as much assistance to the millions of Americans who have lost their jobs during this recession, the impact could ripple outward and begin to affect sectors such as housing.”

The post Late-July Home Sale Prices Up 11%, Largest Annual Increase Since 2014 appeared first on Redfin | Real Estate Tips for Home Buying, Selling & More.